Financial Inclusion

Solutions

Microfinance

Index

complicated question: “what does social impact mean for financial service

providers?”

Fintech

Insights

performance.

CDFI Impact Performance

Impact Due Diligence

Sector Highlights

-

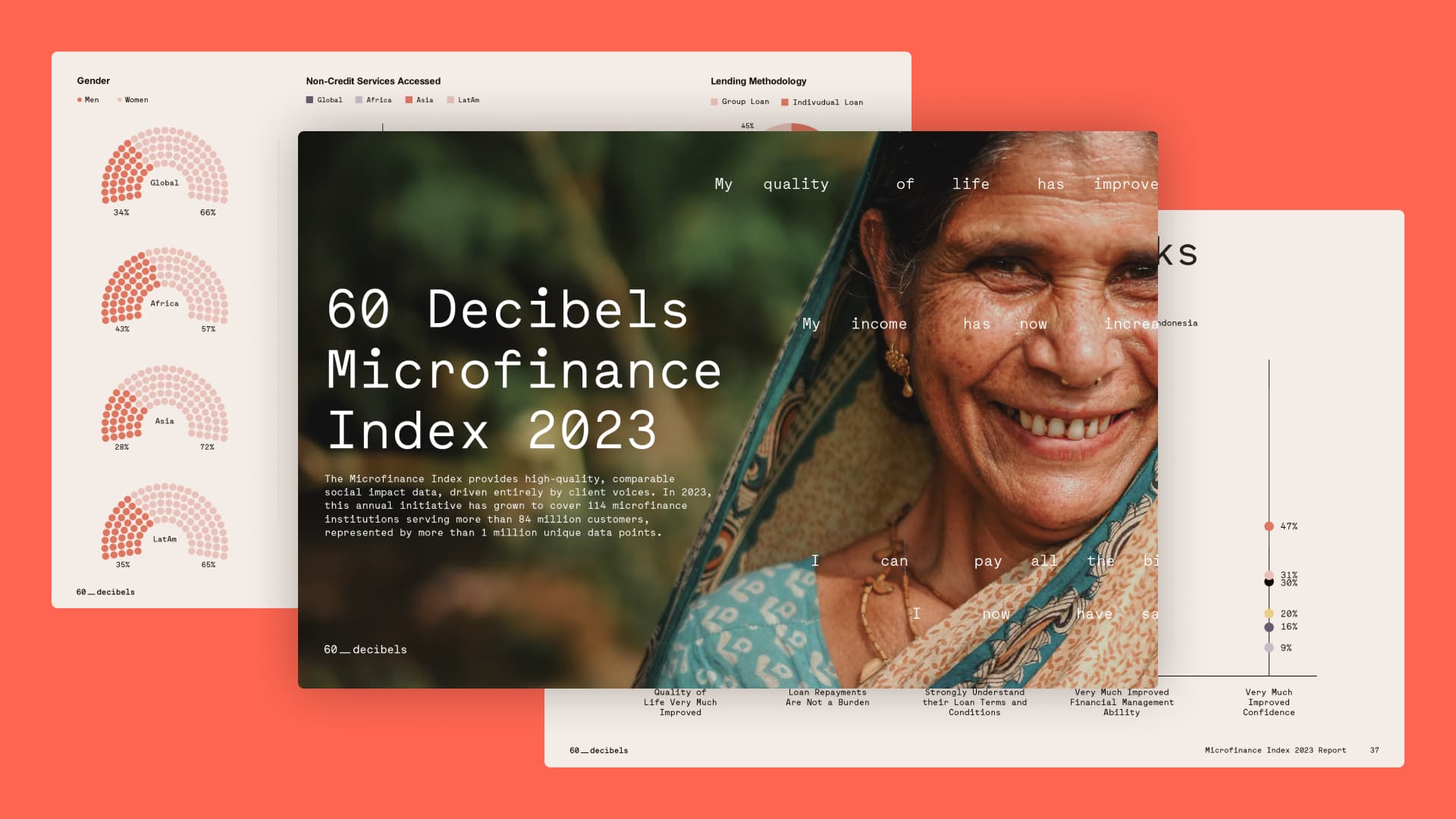

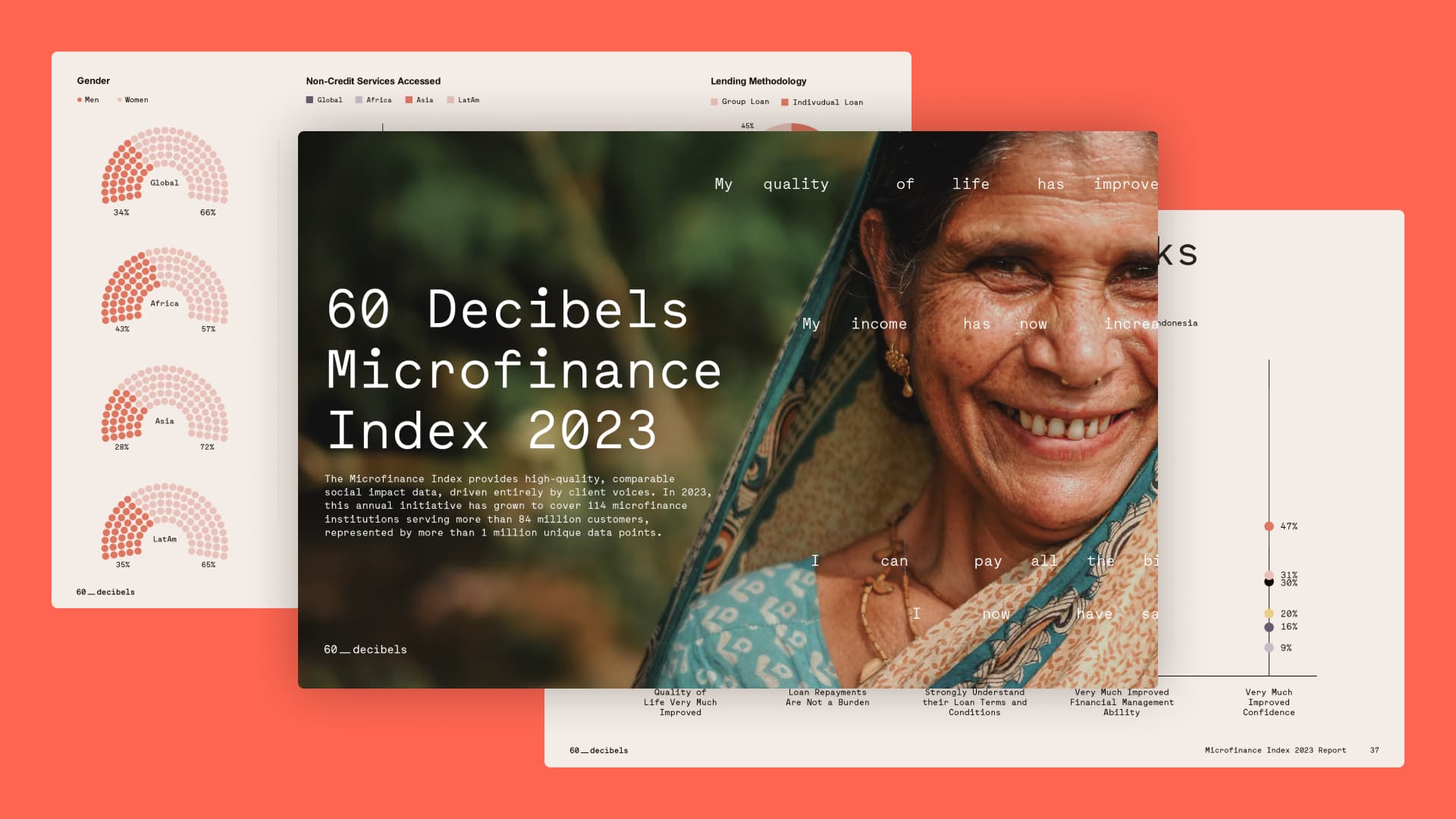

2023 Microfinance Index Report

We listened to 32,000+ clients, bringing our complete Microfinance Index dataset from 2022 & 2023 to include learnings from more than 50,000 clients globally. Check out the report here.

![]()

-

Cambodia Microfinance Report

An in-depth look at the Cambodian microfinance sector and its impact on clients’ businesses, households, resilience, financial management, and agency. Based on phone interviews with 2,939 Cambodian microfinance clients from 10 financial service providers in 2023. Explore the paid report and download a sample here.

![]()

-

Mastercard: Striving to Thrive Part 2 – Czech MSEs in 2023

In partnership with the Mastercard Center for Inclusive Growth program – Strive Czechia – this 2nd edition report delves deeper into technology, gender, MSE perception, and more. Or, download the 2022 report here.

![]()

-

Visa: Unlocking the Benefits of Digital Payments for Micro & Small Businesses in Mexico

A paper examining the results of a survey that gathered insights from 753 micro and small businesses operating within digital payments in Mexico.

![]()

-

Kiva: Impact Study for US Borrowers

In 2022, 60 Decibels teamed up with Kiva US to conduct their first-ever independent impact assessment. Between April and May, 60dB conducted 502 phone surveys, speaking with both Kiva borrowers (80% of respondents) and Kiva applicants to assess Kiva’s impact.

![]()

-

LeapFrog: Emerging Wealth and Health Index 2022

60 Decibels surveyed around 4,000 emerging consumers across eight emerging markets to build LeapFrog’s Emerging Wealth and Health Index, a fascinating survey of the world’s impact investing needs in two key sectors.

![]()