The 2024 MFI Index

126

45

36,000+

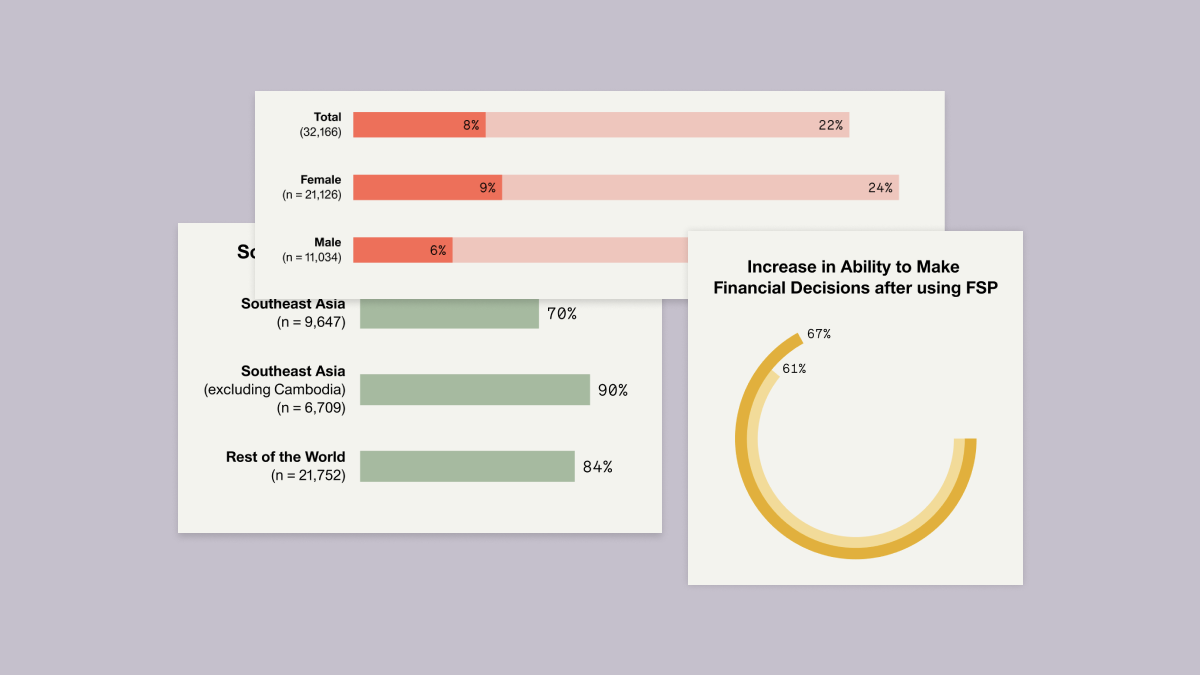

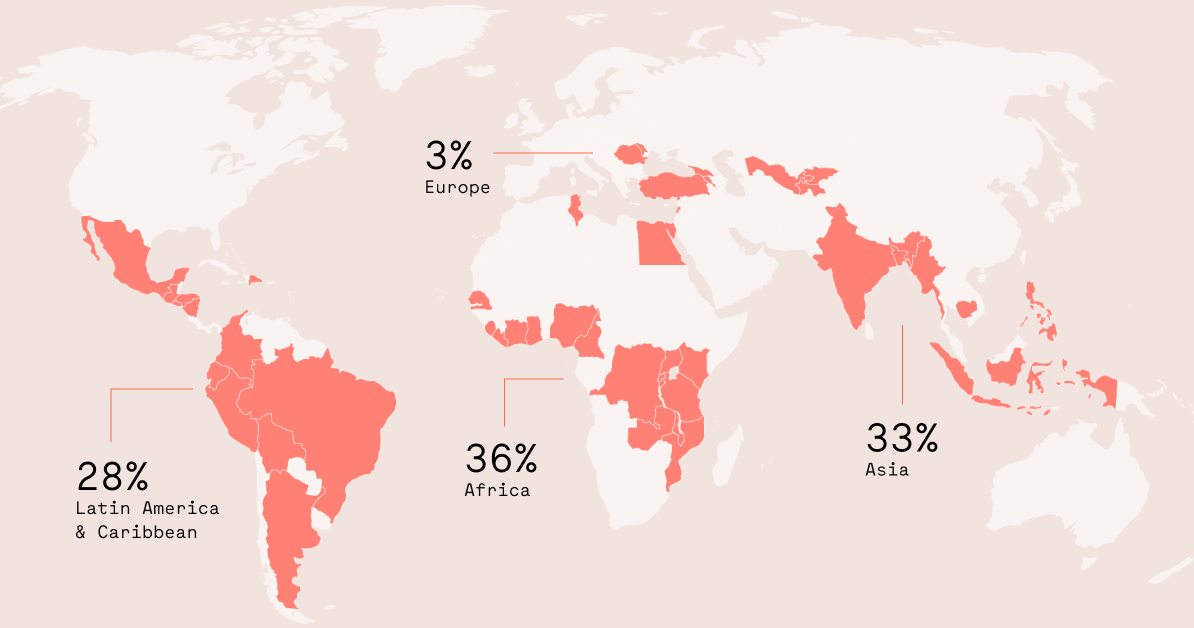

The 2024 MFI Index includes data from more than 126 participating financial service providers (FSPs) and is supported by 27 Partners. Now in its third year, the 2024 Microfinance Index has surveyed 36,000+ microfinance clients in 45 countries representing 32 million people globally, with deeper dives into client protection, gender impact, and climate resilience. This year’s survey gathers quantitative and qualitative data along six key dimensions of impact, including Access, Business Impact, Household Impact, Client Protection, Resilience, and Agency.

The data behind the Index can be harnessed through three new paid tools and our public report can be downloaded here.

2024 Headlines

-

Group loans include excluded groups and close the gender gap

Group lending effectively reaches historically excluded populations, particularly women and rural borrowers. With 85% of group borrowers being women, these loans show impressive results in increased community respect and household decision-making power for women, suggesting that group loans are a powerful tool for gender inclusion.

-

FSPs strengthen client resilience, but moving the needle for more vulnerable clients is challenging

While FSPs improve clients’ lives and financial flexibility, clients who say they’d struggle to meet emergency expenses report lower improvements in most aspects of resilience. This highlights the need for tailored solutions to address the unique challenges faced by vulnerable populations.

-

FSPs improve access and resilience for women; female-centric FSPs lead in empowerment

Women are more likely to use loans to invest in businesses, enhancing their financial resilience. Female-centric FSPs outperform others in improving women’s financial resilience, community respect, and household influence, demonstrating the value of inclusive lending methodologies and the provision of additional services.

-

Mature FSPs outperform younger and older peers in client impact

FSPs operating for 11–20 years deliver better client outcomes, suggesting they have hit a “sweet spot” in effective service delivery. They outperform both newer and legacy institutions in reaching clients without good alternatives and in offering additional services, leading to higher client satisfaction and impact.

-

FSPs build clients’ preparedness and knowledge for climate resilience.

FSPs contribute to clients’ preparedness for climate shocks, especially through group lending and additional services. Clients with longer tenure and access to additional services feel more capable of recovering from climate-related events, highlighting the role of microfinance in building adaptive capacity among vulnerable populations.

MFI Index Webinars

2024 Microfinance Social Impact Awards

-

Winners – Africa

Standard Microfinance Bank (Nigeria)

Grace and Mercy Households Improvement Initiative (Nigeria)

Agora Microfinance Zambia Limited (Zambia)

![]()

-

Winners – Asia

CJSC Bank Arvand (Tajikistan)

Annapurna Finance Pvt. Ltd (India)

Koperasi Syariah Benteng Mikro (Indonesia)

![]()

-

Winners – LatAm

FUNDENUSE (Nicaragua)

MiCrédito, S. A. (Nicaragua)

Fundación Génesis Empresarial (Guatemala)

![]()

Why take part in the Microfinance Index?

Synthesized

Insights

Discover

Top FSPs

Interactive

Data