Fintech Index

Financial Inclusion is the biggest sector we operate in – with over 100,000 impact measurement interviews completed for clients like Mastercard, Visa, Remitly, and more.

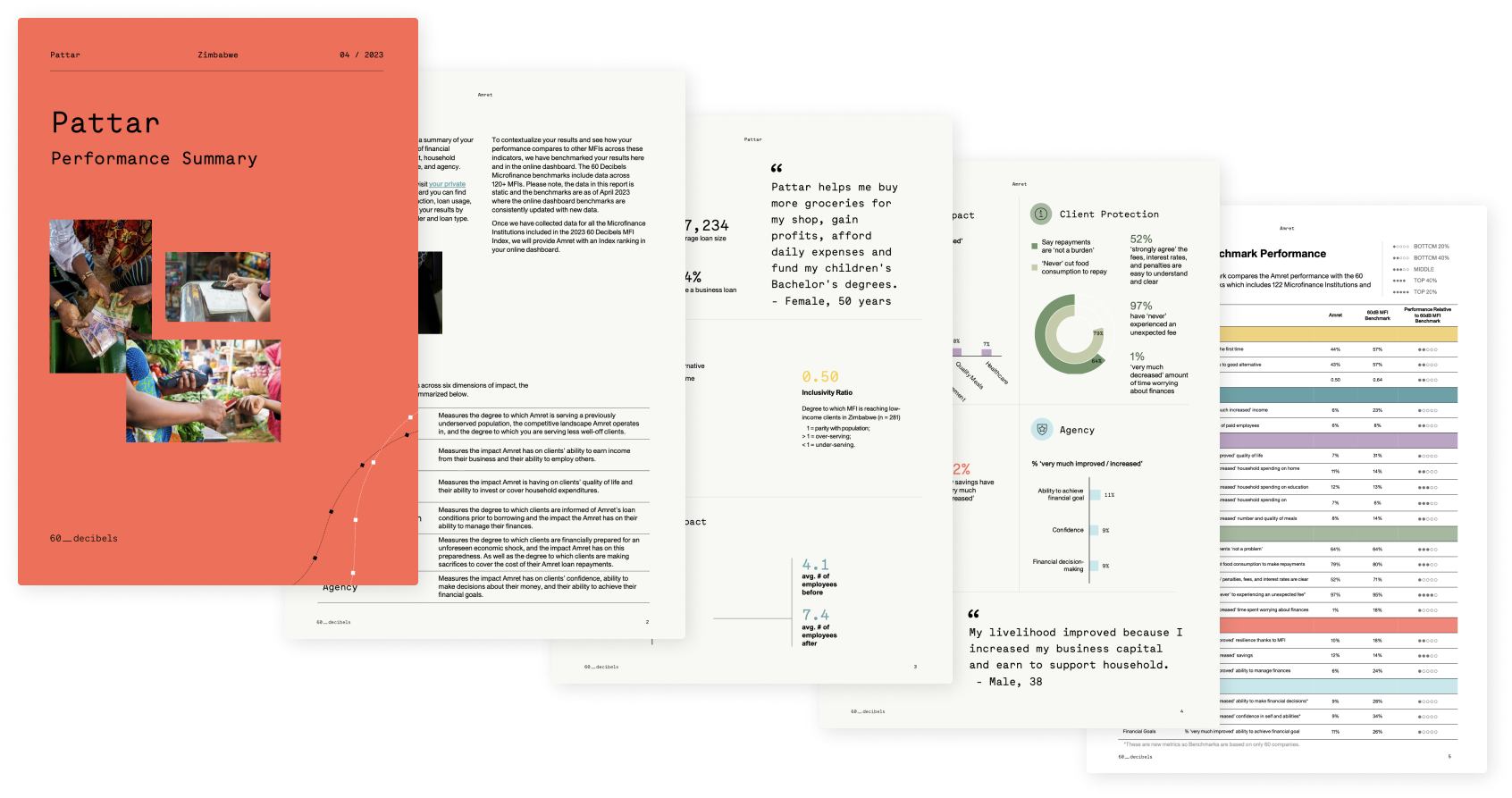

Taking inspiration from the success of our Microfinance Index, our global Fintech Index is building a comprehensive, global data set of customer experiences in the fintech sector. The Index enables fintech companies and investors to reduce barriers to fundraising, harness business development opportunities, benchmark against peers and validate product market fit.

Benefits of taking part

Fintech Index Measurement Dimensions

We’ve conducted hundreds of social impact studies for fintech clients to consolidate the industry’s needs into a core set of impact dimensions.

Access: assess the degree to which Fintechs are serving previously underserved clients, whether these clients have access to a good alternative in the market, and how the poverty profile of these clients compares to the national population. These metrics serve as a good proxy for attribution of impact.

Experience: determine satisfaction and loyalty among Fintech clients, and look at what kind of challenges they experience while dealing with Fintechs, including challenge reporting and resolution.

Impact: measure the direct outcomes experienced by Fintech clients, in both personal wellbeing and business impact. For business owners, we use employment as a proxy for business growth – how the loan might be contributing to job creation.

Consumer Protection: beyond the legal and regulatory framework that Fintechs might follow, we evaluate if they are treating their clients in a fair and responsible manner, while measuring the financial burden that the loan might be adding. We look at data usage, fraud occurrence, ease of interaction, among others.

Financial Resilience: Fintech loans can directly impact the financial resilience of clients, specifically by facilitating financial management, increasing savings buffers, and providing a cushion to withstand unexpected financial shocks.

Deliverables

Talk to us about the Fintech Index if:

- You want comparable metrics from your fintech portfolio to drive investment decisions and portfolio support

- You are a fast-growing fintech company looking for quick, representative customer data that will help you stand out from your peers

- You’re eager to expand the depth and breadth of your impact to drive growth