Rethinking Financial Inclusion: Amplifying the Voices of Savings Account Clients

The importance of hearing from savings account clients

Within the financial inclusion space, the narrative has long been dominated by the provision of credit to the underserved. Whilst loans have a high impact potential, a compelling argument lurks in the background: savings, not just credit, hold the key to true empowerment and resilience for marginalized communities. Savings are not merely a luxury but fundamental to financial resilience, a cornerstone upon which economic stability is built.

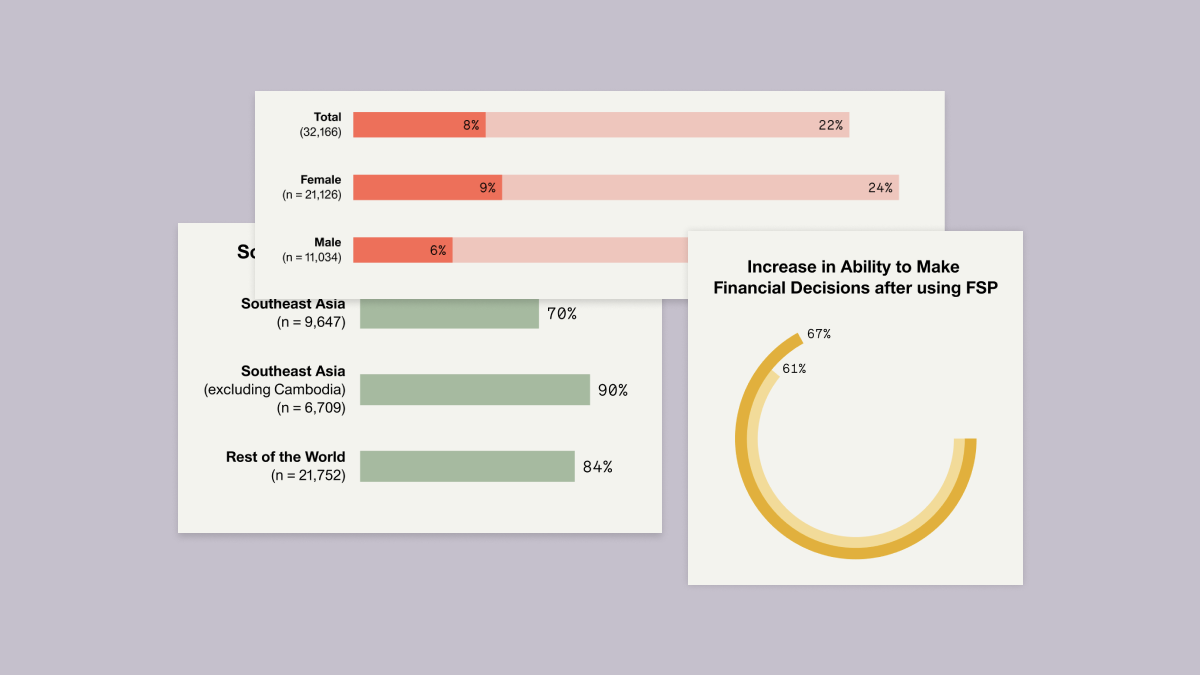

Every year, we hear from thousands of microfinance clients worldwide to understand their lived experience with their financial service provider (FSP) and collate these findings into a global Microfinance Index. Traditionally, our surveys center around credit, seeking to understand its impact and the challenges its beneficiaries face. However, in the 2023 MFI Index, we expanded this work with two organizations (Accion and Opportunity International) and 8 financial service providers, to better understand the impact these same FSPs are generating for clients with savings accounts.

Incorporating savers surveys: a strategic shift

Both Opportunity International and Accion believe that impact measurement in the sector should go beyond the impact of credit – the decision to include a savers survey stemmed from a desire for a more holistic understanding of financial inclusion and their microfinance efforts. They recognize that access to a range of quality financial services, including savings accounts, is essential for meeting the diverse needs, and improving outcomes, for underserved populations. By measuring the extent to which these services lead to positive impact, both organizations aim to ensure that their offerings are comprehensive beyond credit.

Impact of savers surveys: driving organizational strategy

The data collected from the savers surveys in the 2023 MFI Index has proven invaluable for both organizations in both learning about savings clients and also shaping organizational strategy and decision-making. In particular, Accion leveraged the insights to compare outcomes for credit and savings clients, identify trends, and test assumptions. This data not only informs internal strategies but also serves as robust evidence for engaging with external stakeholders. Similarly, Opportunity International has utilized the survey results to demonstrate the positive impact of their FSPs’ savings services to stakeholders, both internal and external. The data has enabled both organizations to identify areas for improvement and engage in meaningful conversations with partners, moving beyond anecdotal feedback to evidence-based discussions for savings clients.

Filling gaps and setting goals for 2024

The savers surveys have filled critical gaps for both Opportunity International and Accion, providing large-scale data on outcomes for savings clients across their portfolios. Accion noted that without this survey, they lacked comprehensive data on savings clients’ outcomes. Opportunity International highlighted that before the introduction of the savers surveys, their impact measurement surveys did not adequately represent savings-only clients, who constitute a significant portion of their clientele.

Looking ahead to 2024, both organizations aim to build upon the success of the savers surveys in this year’s MFI Index. They aim to validate, replicate, and analyze findings in more detail across a greater number of financial service providers, thereby enhancing their ability to report a more holistic set of results and use the findings to drive further impact.

Through listening to end-users, we want to highlight the transformative potential of gathering data on savings clients. This, in turn, will enhance impact and foster resilience for marginalized clients. It is great to see leadership from Accion and Opportunity International enabling exploration into the vital role of savings in empowering these clients, and we look forward to others joining us in this work.

As we prepare for the launch of the 2024 Microfinance Index, we’re committed to further amplifying the voices of savings account clients. Get in touch here to find out more about how we can work together to achieve this mission.