Wrap-Around Services Are Changing the Face of Microfinance – For the Better

Devin Olmack, Microfinance Index lead at 60 Decibels, explores how results from the 2023 MFI Index can answer the question: “what is the impact of wrap-around services on microfinance customers?”. This article was originally published on NextBillion.

Since it was first offered five decades ago, formal microfinance has existed to create financial inclusion and economic opportunity for clients. The financial service providers (FSPs) providing these services have a longstanding commitment to enhance the well-being of their clients by helping them to invest in their businesses, strengthen their households and improve other social outcomes.

While loans have always been at the heart of microfinance, many institutions understand that loans alone are not enough to create meaningful impact. Recognizing this, many FSPs now offer additional services aimed at increasing the impact of their loans. These services range from training, education and health support to savings, insurance and payment solutions. Collectively, these wrap-around services aim to provide borrowers with the tools they need beyond credit to succeed.

One of the core questions 60 Decibels aimed to answer with our 2023 Microfinance Index was: What is the impact of these wrap-around services on microfinance customers? To answer this question, we combed through more than 1 million data points gathered through conversations with over 32,000 microfinance borrowers at 114 different FSPs across 32 countries.

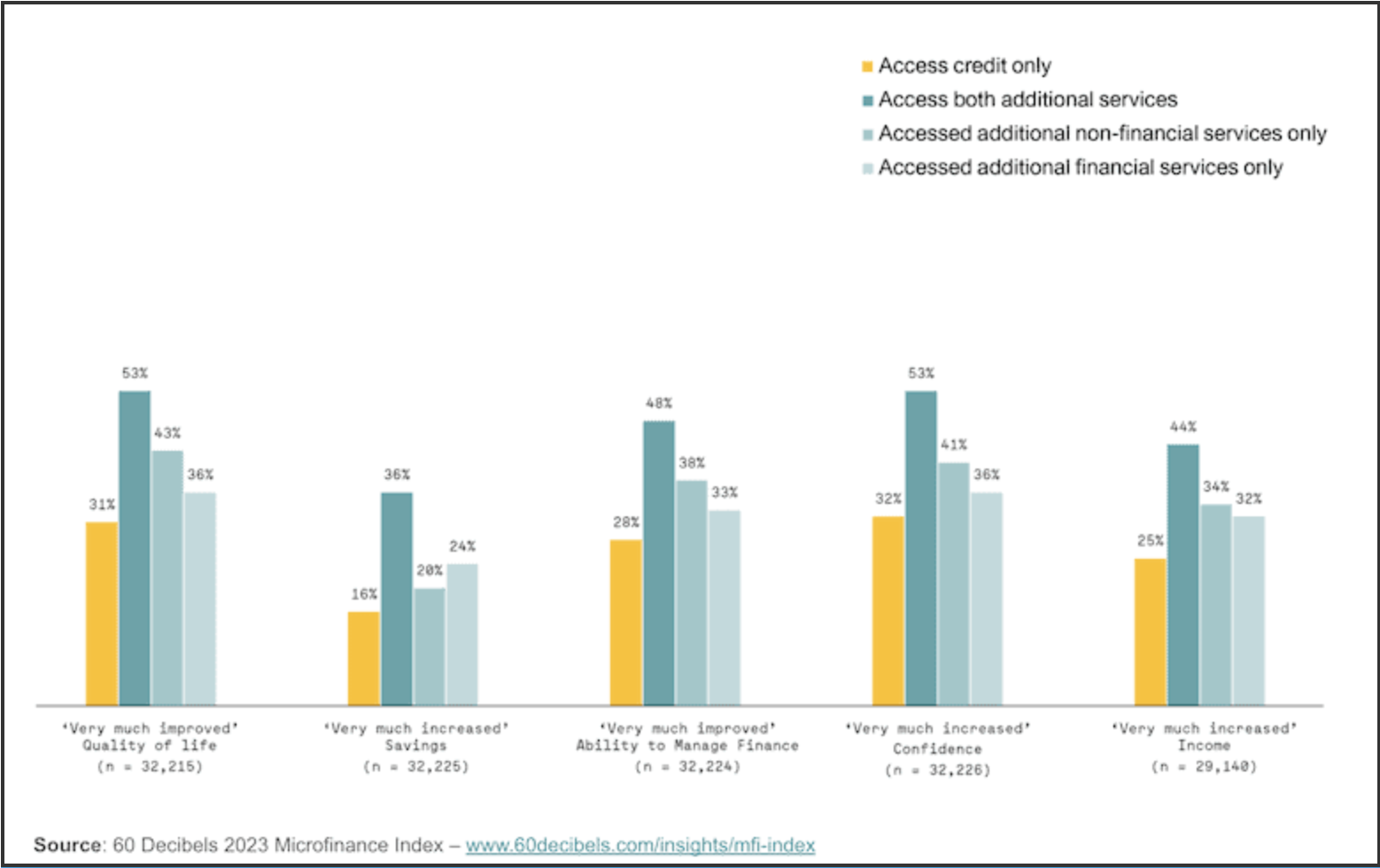

The results were clear: Borrowers who access a mix of non-financial and financial services from FSPs have better outcomes than clients who only access loans.

These findings suggest that these wrap-around services, when delivered effectively, should be at the heart of social impact strategies for FSPs. They show the increasing need for financial service providers who aim to drive impact in microfinance to support the holistic needs of their clients, by offering a spectrum of services beyond microcredit and encouraging clients to use those services.

Microloans reach business, fostering entrepreneurial success

Microfinance, at its core, is designed to be a catalyst for business growth. However, there has been a lingering debate about the actual use of microloans: whether they predominantly go toward individual consumption, or genuinely drive business expansion. Based on our data, the answer to that question is clear: Clients tell us they use their loan for business, and their businesses are growing because of it.

Indeed, our findings challenge the prevailing notion that microloans are often diverted towards consumption. A resounding 83% of the clients we interviewed this year said that they deployed their loans exclusively for business purposes, either to nurture an existing venture or launch a new one.

Diving into the actual impact on business, the use of wrap-around services correlates with better business outcomes: Clients who harness a blend of financial and non-financial services see more entrepreneurial success. Almost double the proportion of clients who use both financial and non-financial additional services (44%) assert that their business income has “very much increased,” compared to their counterparts who rely solely on credit (25%). This serves as a powerful testament to the tangible benefits of embracing a holistic suite of services. It showcases how augmenting credit with financial literacy, business-related services, savings or insurance products propels entrepreneurial ventures to thrive and prosper, ultimately amplifying the promise of microfinance.

Bolstering households’ financial securitu and quality of life

Our data shows that microfinance customers’ lives are improving: Their households report improved quality of life and greater financial security. Clients who opt for both non-financial and financial services, in conjunction with their loan from the FSP, see the largest increase in reported quality of life. For clients who use both financial and non-financial additional services, 53% of them attest to experiencing a “very much improved” quality of life. Comparatively, 31% of borrowers who only accessed credit reported their lives “very much” improving. This 22 percentage point difference is a testament to the transformative power of a comprehensive microfinance approach.

The impact of additional services on savings balances is similarly noteworthy. Savings is a key tool for improving a borrower’s financial stability and ability to overcome unexpected shocks. Clients who engage with both non-financial and financial services in addition to credit report a 36% increase in savings, compared to 16% among credit-only clients (a 20 percentage point difference). Expanding FSP offerings beyond solely loans can more than double the number of borrowers who increase their savings, improving the financial health of households.

Individuals see improvement in confidence and financial management

We also studied how access to microfinance impacts personal skills and agency. Once again, clients who use a mix of wrap-around services see the biggest benefit to their personal financial management and confidence. An impressive 48% of borrowers who use both financial and non-financial additional services report significant improvements in their ability to manage their finances, compared to the 28% of clients who solely rely on credit from their financial service provider. When analyzing self-confidence changes, wrap-around service clients report a 53% increase in their confidence, compared to the 32% reported by clients who do not access these services.

Interestingly, accessing only supplemental non-financial services (in addition to credit) correlates with improved quality of life, financial management, confidence and income more than only using additional financial services like savings and insurance (alongside credit).

Our research shows that the clients benefiting most from these additional services tend to reside in rural or peri-urban areas and are predominantly female. However, when studying the relationship between clients’ location or gender and the outcomes mentioned above, we find that these differences are not statistically significant. For example, 83% of wrap-around service clients in both rural/peri-urban areas and urban areas reported an increase to their business incomes. This means that the success of wrap-around services remains consistent, regardless of other client characteristics.

Understanding clients’ use of wrap-around services

Of the 114 FSPs that participated in the 2023 Microfinance Index, two thirds offer non-financial services in addition to financial services. However, only a quarter of clients in our dataset used any of these services in addition to credit from their FSP in the past six months. That means that these products exist, but borrowers aren’t taking full advantage of them.

We want to investigate this finding more deeply, because the impact of these non-financial services could be given very different interpretations, depending on what’s driving it: The services themselves could be generating the impact we’re seeing. Or clients who choose to use wrap-around services could simply be the most proactive clients in areas like growing their business and improving their savings. In other words, there may be something about the clients who use these services that is the driver of outsized impact, rather than the presence and availability of the services themselves.

The most impactful loans are more than just… loans

This data allows us to conclude with more certainty that the greatest catalyst for change for microfinance clients lies in the comprehensive support ecosystem created by FSPs. As the financial inclusion industry confronts new challenges every year, FSPs must adapt to better meet clients’ needs — and this research highlights a clear client need for services that go beyond credit.

We recommend that FSPs view these findings as another reason to continually work to provide broader service offerings, from education to savings to insurance, to better improve the lives of borrowers around the world.

Check out the full 2023 MFI Index report here, or find out more about the 2024 MFI Index here!