How we collected 1,000,000+ data points for the 2023 Microfinance Index

The 60dB Microfinance Index (Global coverage)

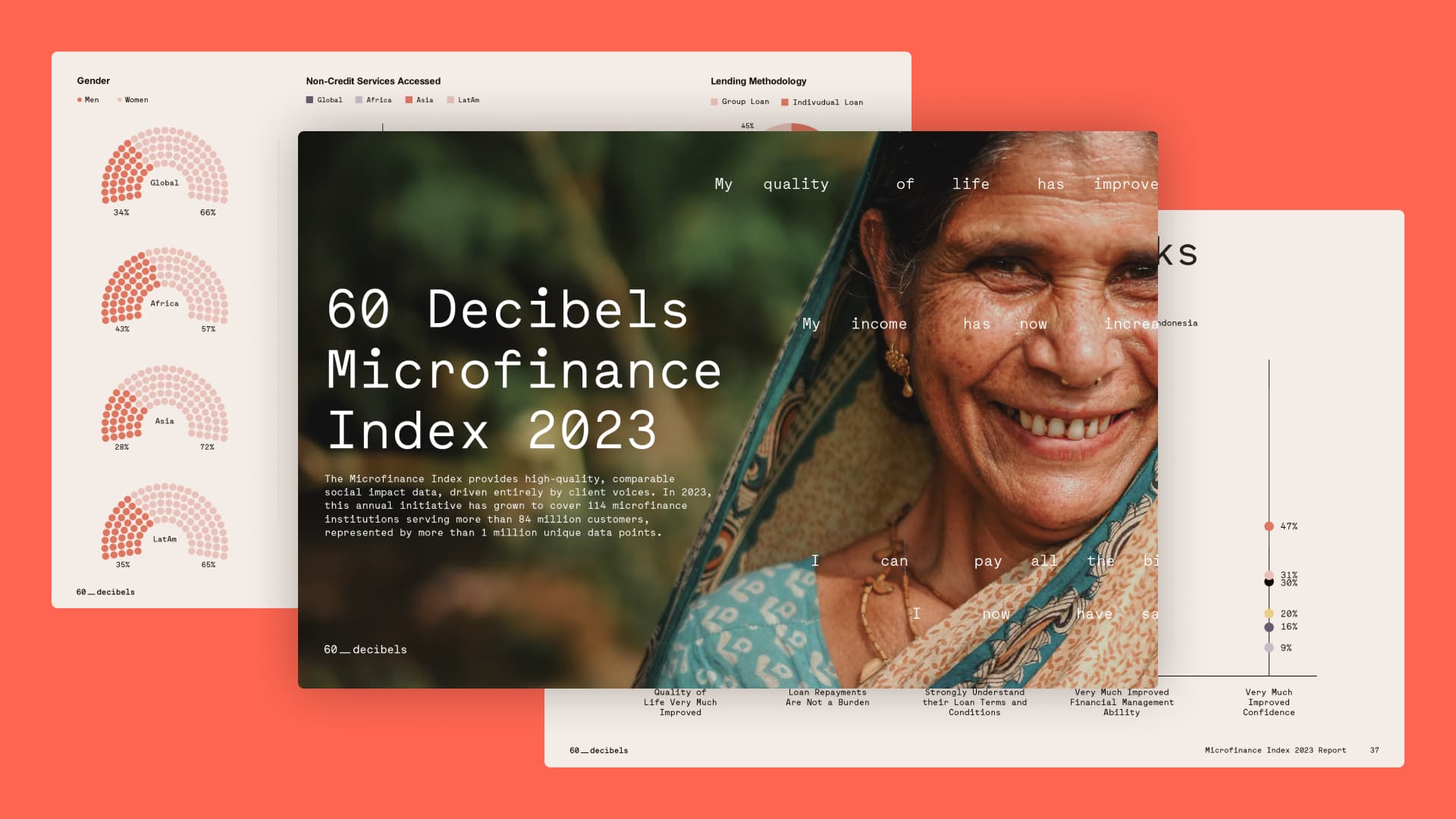

Between November 2022 and June 2023 our team of Research Assistants collected data for our second, and largest, Microfinance Index. We spoke to over 32,000 clients of 114 financial service providers (FSPs) in 32 different countries – that translated to over 650,000 minutes of listening to end users. The result was 1 million unique global data points on the lived experience of microfinance users. We’re delving deeper into how we collected the data for a groundbreaking financial inclusion initiative providing high-quality, comparable impact data for the sector as a whole.

Ensuring a representative sample

To kick off the data collection process, we start by asking the FSP to provide a list of their clients with contact details, ensuring the number of clients is large enough to extract a representative sample. We verify the sample we select from the client population is representative by comparing how our randomized sample demographics such as gender and location compare to the FSPs overall client population. Once samples have been selected, our network of 1,300+ trained in-country Research Assistants are ready to start making phone calls.

Conducting the phone calls

We want to make sure FSPs and clients feel prepared before any phone conversations take place, that’s why we don’t speak to FSP clients without first giving them a heads-up. We send clients an SMS before calling to let them know a Research Assistant from the 60 Decibels team will call them soon to hear about their experience with their FSP. This gives the client time, if they need it, to verify with their FSP that our phone call is legitimate. We also encourage the FSPs to communicate with their clients, branches, and agents that a survey is ongoing and they may hear from the 60dB team. It’s also a strategy that increases our response rates.

From our selected sample we reach out to each client up to three times – we believe three times strikes the balance between having a good chance of getting a response, and making sure clients don’t feel pestered. Our friends at IPA also found in a study of mobile phone surveys in nine countries that survey completion rates were highest for first and second call attempts and then the same for third, fourth, and fifth call attempts. Meaning, we aren’t likely to increase response rates after the third call attempt. Average response rate of MFI Index projects in 2023 was 54%, and we found response rates in Sub-Saharan Africa to be higher than Latin America. Our team continues with phone calls until we have reached a sample of 275 clients per each FSP. That’s when we start analyzing the results.

Data analysis

The results from the phone calls and surveys with clients are shared around 3-4 weeks after we finish data collection with the FSP. We don’t just hand over the raw data; we present it alongside global, regional, and in some cases country benchmarks to give the FSP a better indication of how their performance compares to other organizations in the sector. The FSPs have the ability to segment their data by gender, product type, lending methodology, and client tenure.

Lastly, we bring the data from all the FSPs together and aggregate it for the Microfinance Index – the world’s largest financial inclusion index grounded in customer voice.

Interested in participating or accessing the data from the 2024 MFI Index? Get in touch.