From Credit to Confidence: How Financial Institutions Are Strengthening Client Resilience

Client resilience is becoming a top priority for financial service providers (FSPs) and the investors who support them. As climate shocks, health crises, and economic volatility increase, providers are expanding their focus: from access to credit toward helping clients prepare for and recover from unexpected events. At 60 Decibels, we’ve seen this shift firsthand—and we’re helping our partners measure how their services are building client resilience.

Measuring More Than Financial Health

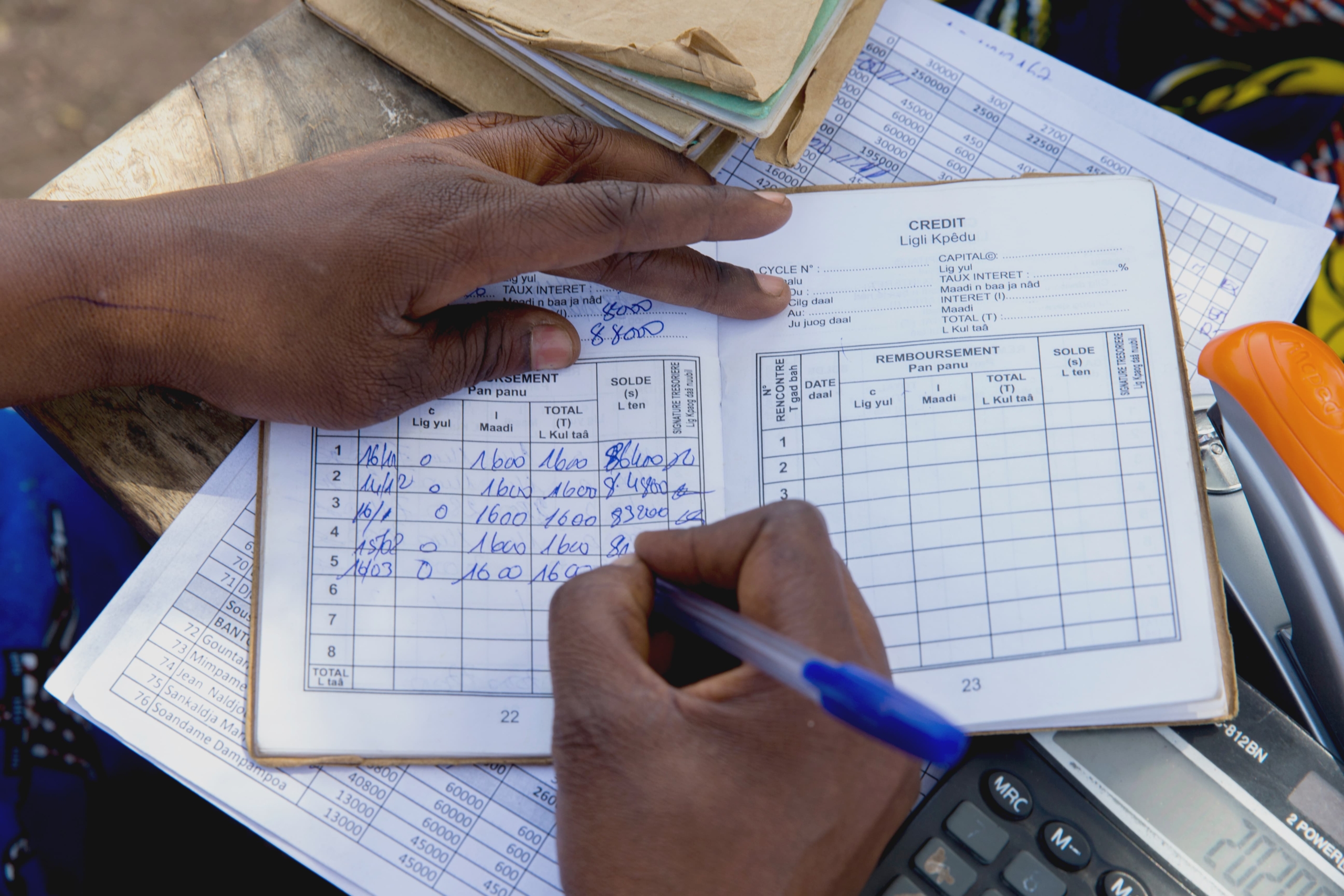

The 60 Decibels Microfinance Index (MFI Index) has always tracked indicators of financial resilience, such as whether clients are saving more, feel more in control of their finances, or can come up with emergency funds. We explored this relationship between financial resilience and credit from the 2023 Index.

But for the 2024 MFI Index, we took it a step further. For the first time, we introduced an optional Climate Resilience Module that allowed participating FSPs to explore how their products impact their clients’ perceived and realized resilience—especially in the face of climate, health, and economic shocks.

Nineteen FSPs opted in, and the data they collected has revealed some powerful patterns.

What We Found: Climate Shocks Are Common–But So Are Signs of Hope

One of the clearest signals from the data: shocks are widespread. About one-third of clients we interviewed reported experiencing a climate-related shock in the past two years. The most common? Drought or prolonged lack of rain—a risk that disproportionately affects rural and agricultural households.

But the story doesn’t end there. Encouragingly, we found that access to financial services does make a difference in how prepared people feel to handle these shocks. 46% of affected clients said they were more prepared for the event because of the FSP. However, 25% said they were less prepared which could be related to the burden of repayments in the face of a shock.

What’s Working: Going Beyond the Loan

Clients who received additional services beyond credit—for example, insurance products, financial education, or bundled services–were more likely to report that the FSP increased their financial resilience.

In other words, loans alone help—but loans paired with services designed to manage risk or improve financial literacy help more.

This finding reinforces what many sector leaders are already starting to act on: that bundled services and client-centric products can lead to more durable outcomes. When clients understand how to manage risk, when they have a safety net (like insurance), and when they feel confident in their financial decisions, they’re more likely to withstand future shocks.

Why This Matters for the Sector

Resilience isn’t a buzzword—it’s quickly becoming a defining metric of success in financial inclusion. And as climate risks, economic pressures, and uncertainty grow, FSPs will be judged not just by the reach of their services, but by the depth of their impact on clients’ lives.

By offering the Resilience Module in the MFI Index, we’re helping providers and investors understand not just what their clients are doing, but how they’re feeling—and how well-equipped they are to bounce back when things go wrong.

The insights from this first year of data are just the beginning. We’re excited to continue supporting FSPs as they build resilience into their offerings and deepen their impact on the lives of those they serve.