60 Decibels Microfinance Index (2022)

17,956

41

72

In 2022, 60 Decibels launched the world’s first financial inclusion social performance report centered in customer voice.

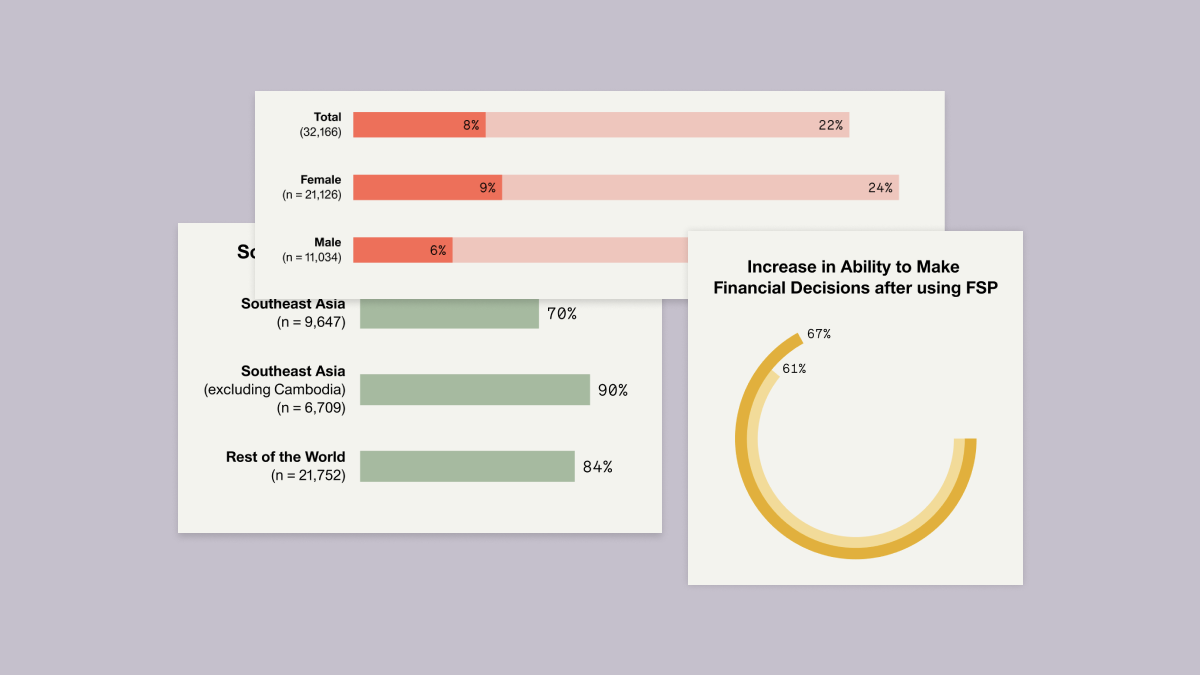

The 60 Decibels Microfinance Index showcases the comparative social performance of 72 microfinance organizations (MFIs), based exclusively on what we heard from 17,956 of their clients. Collectively, these MFIs are serving more than 25 million clients in 41 countries, more than 15% of all microfinance clients globally.

Each of the 72 participating MFIs received a report with results measured across five areas: access, business impact, household impact, financial management and resilience. These were then benchmarked regionally and globally, allowing for assessment of performance among different MFIs. The MFIs that ranked the highest across all 5 dimensions, at either a regional and global level, were given a Top Performer status.

‘It [MFI loan] favored me to improve the facade of my ice cream business, which gives me a higher income and afford expenses as a single mother.’

– MFI Client

The report confirms the ability of MFIs to reach people without access to financial services, with over 50% of clients accessing a loan for the first time through the microfinance institute used. This was especially true for women and lower-income clients. Importantly, clients reported a significant improvement in their standard of living, with 88% of borrowers reporting that their repayments are ‘not a burden’. Meanwhile, 48% said that their stress levels had ‘very much decreased’.

Additional findings included that the top MFIs are in Sub-Saharan Africa. While less than half of the MFIs surveyed were located in this region, they make up all top 10 organisations in the Index. Possible reasons for this included lack of alternatives, higher poverty prevalence, or greater benefits being experienced by lower-income clients.

To find out what other insights were included, take a look at the MFI Index Report below.