Early Data Insights from the 2023 MFI Index

The 60dB Microfinance Index is the world’s largest financial inclusion initiative grounded in customer voice. The Index provides high-quality, benchmarked impact data for the microfinance industry. Find out more about this year’s MFI Index here.

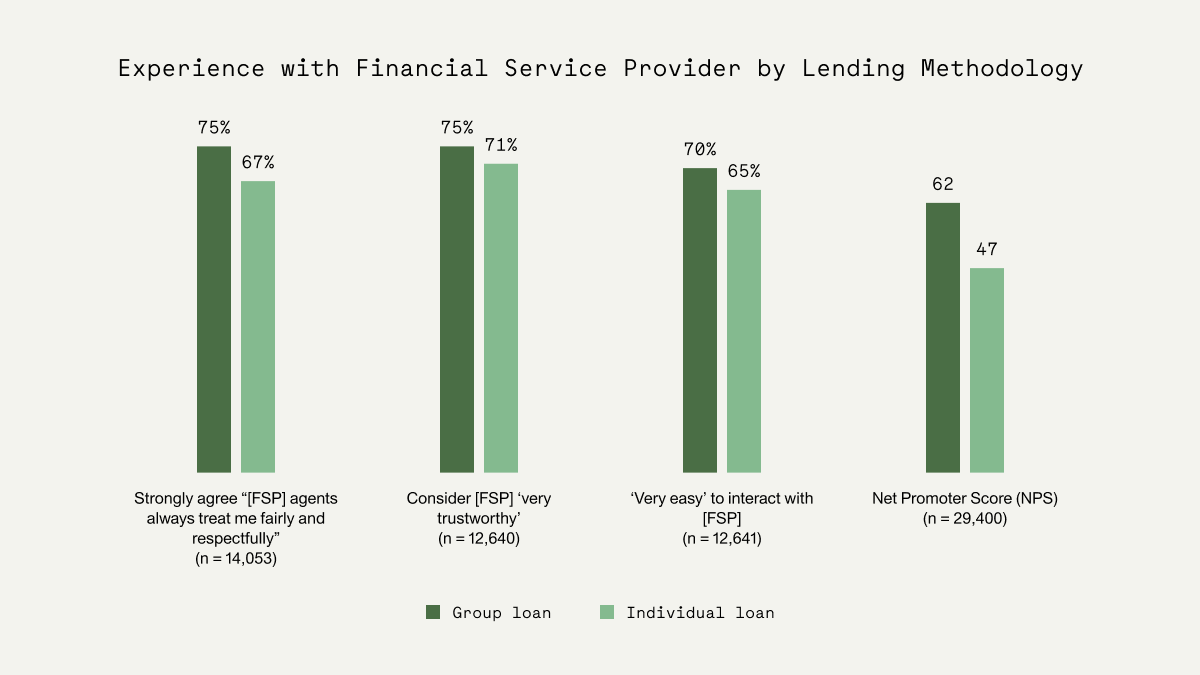

1. Clients with group loans report a better experience with their Financial Service Provider (FSP) than those with individual loans.

75% of clients with group loans report that agents of the FSP treat them fairly compared to 67% of individual loan clients. The Net Promoter Score (NPS) for group loan clients is strong at 62 compared to the NPS for individual clients which is 47.

__________________________________________________________________________________

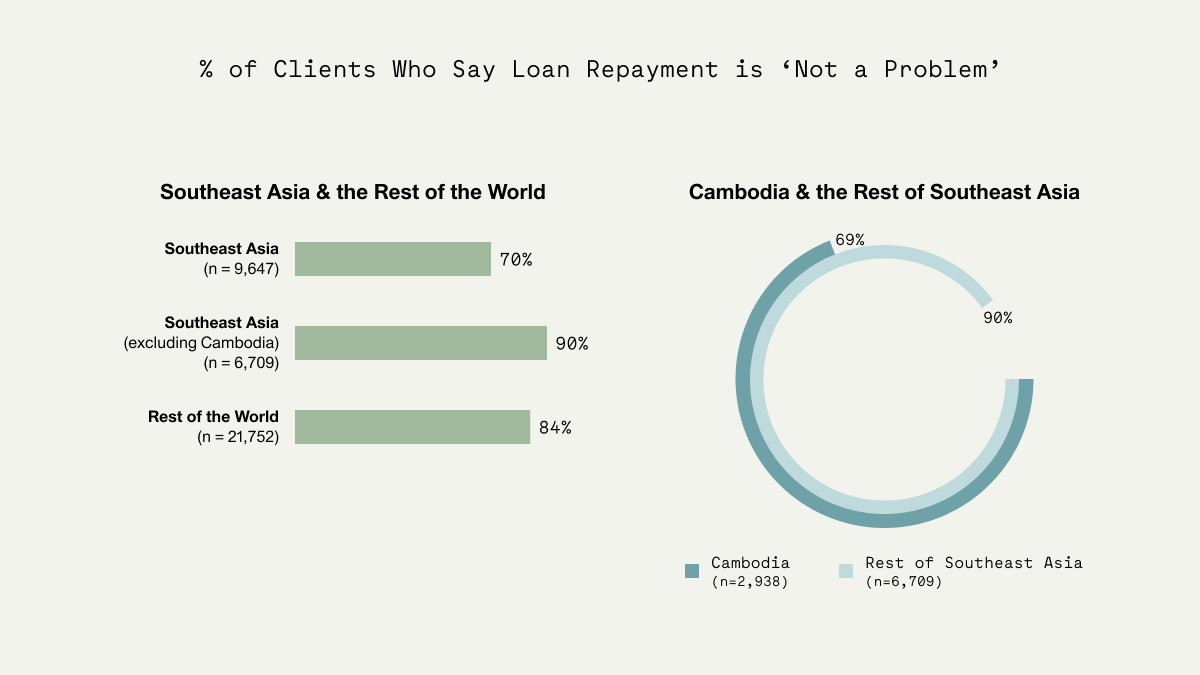

2. Clients in Southeast Asia report their loan repayments are a burden more often, driven by results from Cambodia.

84% of clients in the rest of the world say their loan repayments are ‘not a problem’ compared to 70% of clients in Southeast Asia.

If we separate Cambodian clients from the rest of Southeast Asia, 69% of clients in Cambodia report their loan repayments are ‘not a problem’ and 90% of clients in the rest of Southeast Asia say the same.

__________________________________________________________________________________

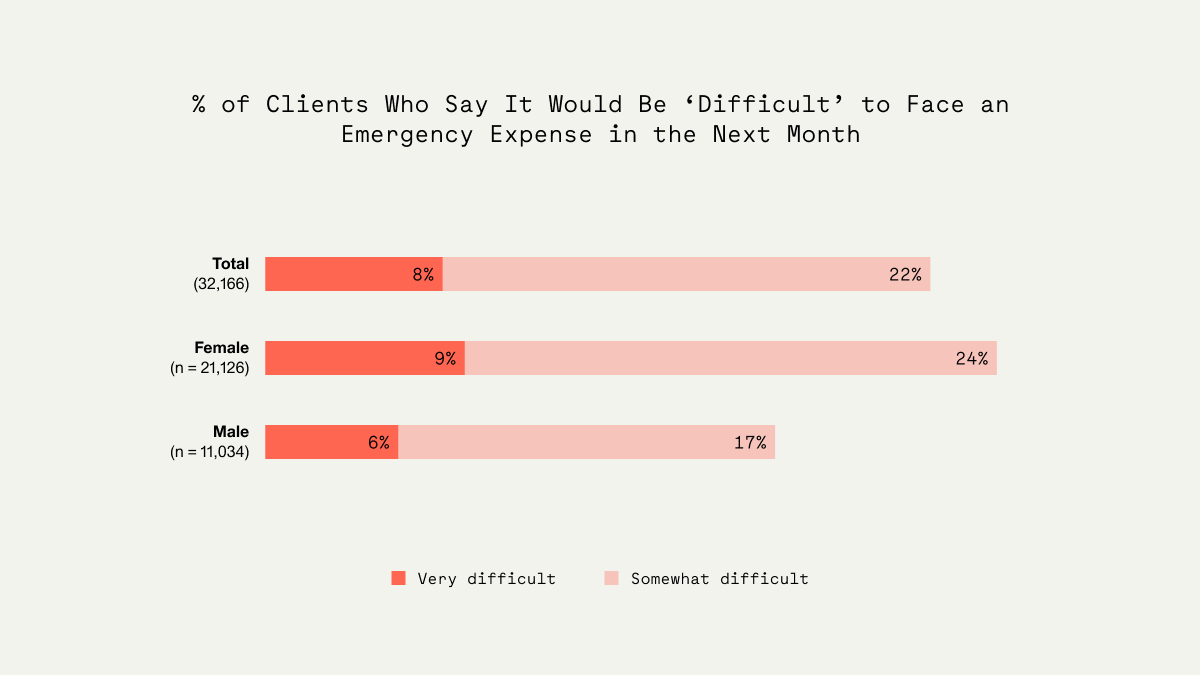

3. Microfinance clients continue to report higher confidence to deal with a future shock than the population as a whole.

The Global Findex in 2021 reported that 32% of adults in developing countries say it would be ‘very difficult’ to fund an emergency expense* in the next month. Conversely, of the microfinance clients we spoke to only 8% say it would be ‘very difficult’ to come up with such an emergency expense.

In addition, we found that females are considerably more likely than males to find it ‘difficult’ to fund an emergency experience – 33% of females would find this difficult versus 23% of men.

While this isn’t a perfect comparison—because of the different question construct—it suggests that the MFI clients we spoke to are more resilient than the average across developing countries.

* Equal to 1/20th Gross National Income (GNI) per capita

__________________________________________________________________________________

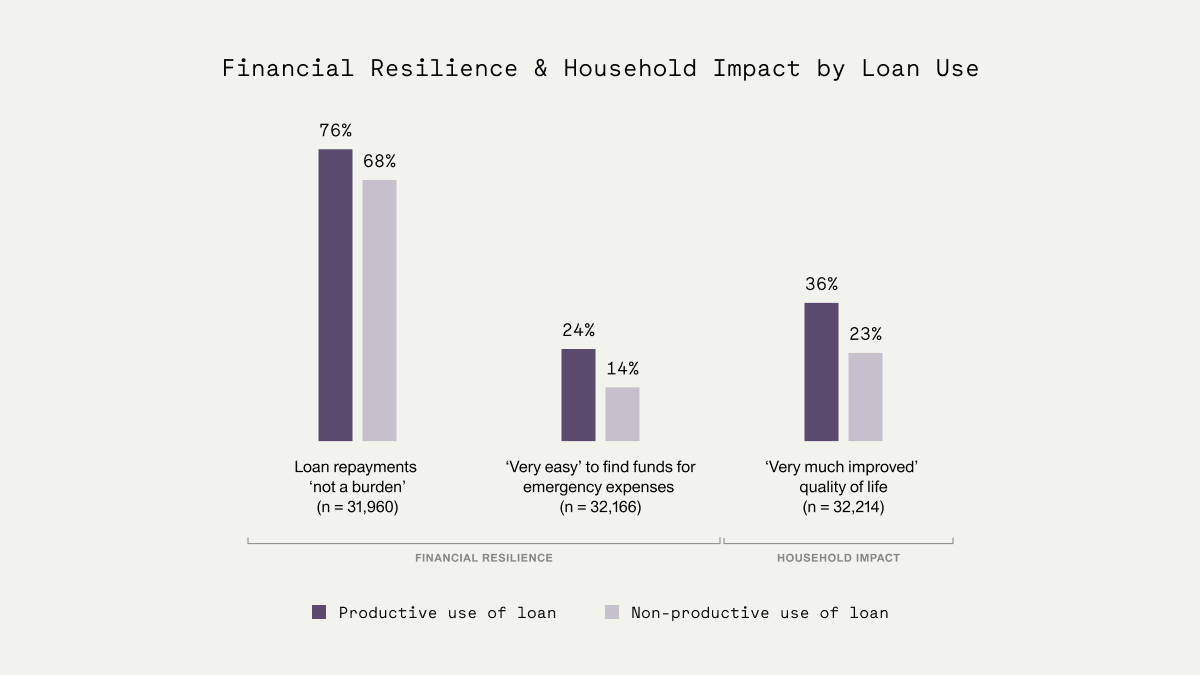

4. Clients who use their loan for business (productive) purposes report better outcomes in financial resilience and in their households.

83% of clients use their loan for at least some business purpose.

Clients who use their loan for productive purposes also report greater increases in the amount they spend on their child’s education, healthcare, meals, and home improvements.

__________________________________________________________________________________

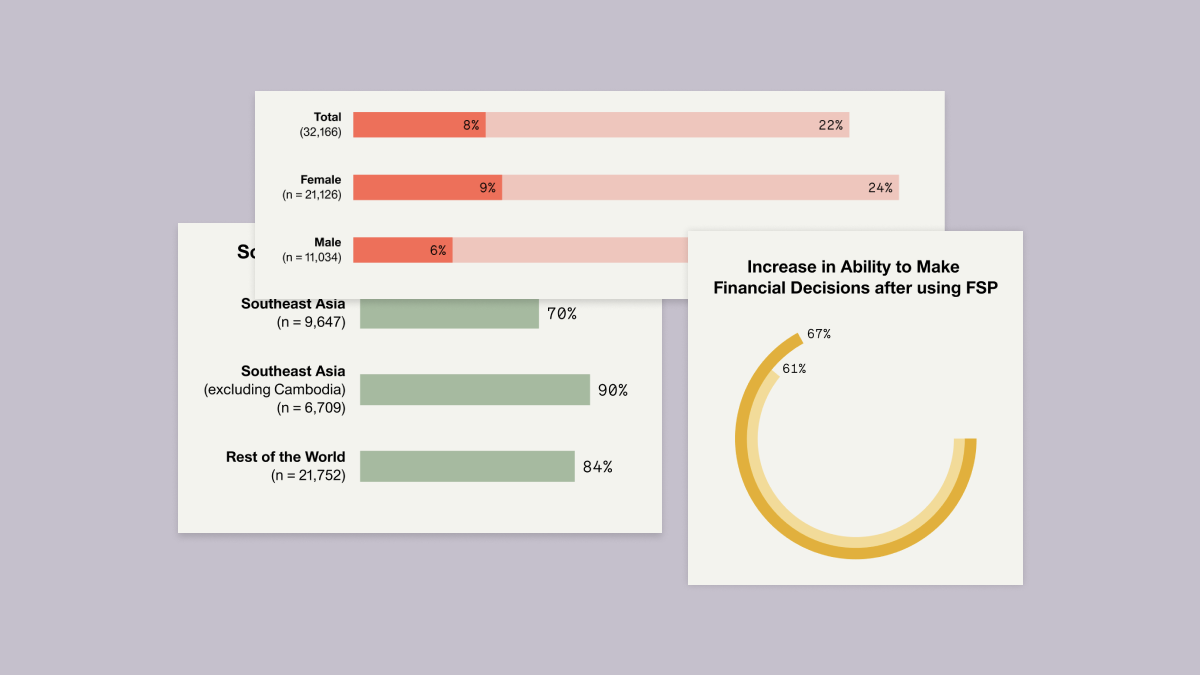

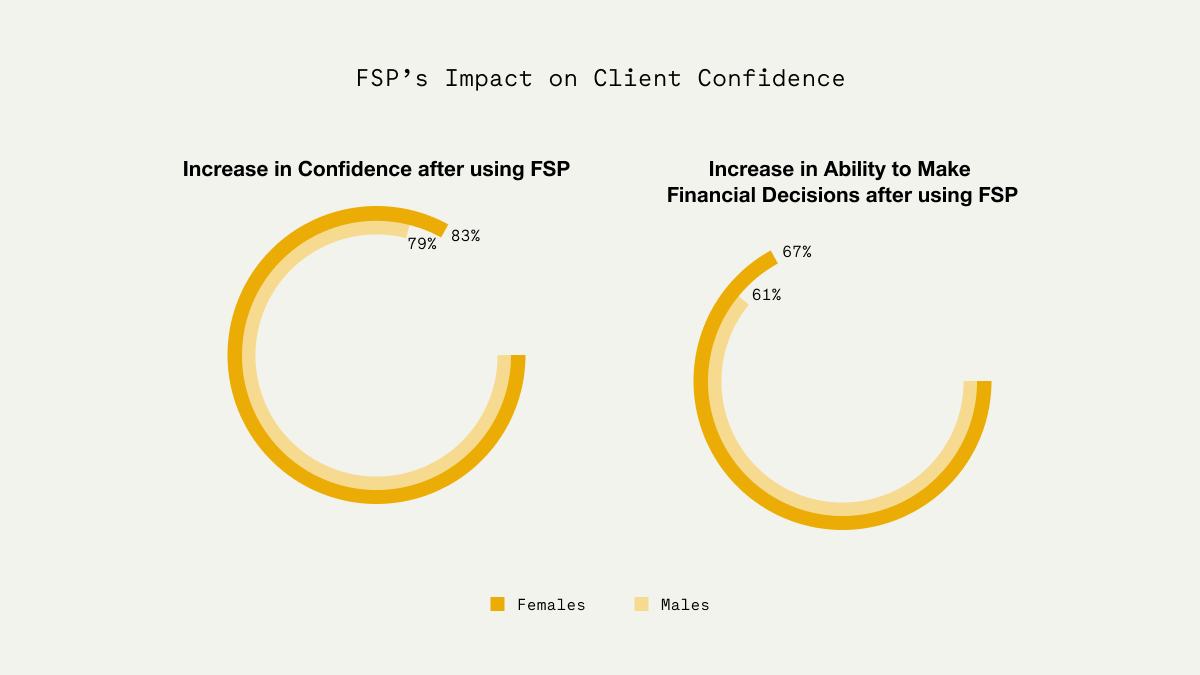

5. Females report slightly stronger outcomes in confidence and decision making compared to males, two indicators within the agency dimension.

In 2023, we introduced Agency as a new dimension to the 60dB Microfinance Index. The Agency dimension measures the impact FSPs have on clients’ confidence, ability to make decisions about their money, and their ability to achieve their financial goals.

Females report slightly stronger outcomes in confidence and decision making compared to males:

> 83% of women say their confidence has increased because of the FSP (compared to 79% males).

> 67% of women say their ability to make financial decisions without consulting their spouse or another adult has increased because of the FSP (compared to 61% males).