From Payday to Any Day: How Earned Wage Access is Reshaping Financial Habits

When workers run out of money before payday, their options are limited. Borrowing from friends and family, taking out high-interest loans, or cutting back on essentials creates stress and financial strain. Access to already-earned wages offers a potential solution – this is the core issue that Earned Wage Access (EWA) products address.

About Earned Wage Access

Earned Wage Access (EWA) is a financial service that allows employees to access a portion of their earned wages before their scheduled payday. Also sometimes referred to as early pay, instant pay, or on-demand pay, EWA emerged in the 2010s in North America to help employees manage their finances between pay periods. This service is especially beneficial for low-wage and hourly employees. The demand for EWA has grown as employees face increasing economic shocks and financial instability along with seeking greater financial flexibility. As EWA expands into developing countries and gains wider adoption, further research is essential to understand its business models, impacts, and regulatory challenges from the perspectives of employers, employees, and financial regulators.

60 Decibels Work with Earned Wage Access

We conducted research with three EWA providers – Ekko in Vietnam, KarmaLife in India, and Paywatch in Malaysia to explore how employees engage with EWA, its effects on financial well-being, and its implications for employers.

All surveyed users accessed EWA through their employers as a workplace benefit. Our analysis focuses on the impact of EWA on employees’ lives, as well as their experiences with the service. We also collected information from each provider about their business model and fee structure.

While this study highlights key themes and learnings, it is not an exhaustive analysis of the broader EWA ecosystem. It complements an upcoming landscape report by ILO’s Global Center on Digital Wages for Decent Work on EWA, synthesizing additional qualitative research with workers and providing perspectives from key stakeholders in the EWA ecosystem including EWA services providers, employers regulatory bodies.

Although all three providers operate through employer partnerships (B2B2C platforms), they have distinct fee structures:

- a flat transaction fee

- a dual fee model based on employer agreements

- and a usage-based fee structure.

Withdrawal limits are influenced by employer input, shaping how accessible earned wages are for employees.

The sample of Paywatch users was primarily full-time employees working in the retail sector, while that of Ekko consisted of full-time employees working in manufacturing and facilities, and KarmaLife’s sample comprised gig workers.

Summary of Key Findings

1. Earned Wage Access is a preferred source of capital for users and is primarily used to manage regular household expenses

Across the three service providers, nearly all users are accessing a service like EWA for the first time, and it is the most preferred method of financing. Over the past six months, most users relied solely on EWA as a source for their credit or capital needs, with 87% of users from Ekko, 70% of users from KarmaLife, and 60% of users from Paywatch use it as their primary financial resource. Even among those who used additional sources of capital, EWA remained the preferred option across all service providers.

Our research indicates that 50% to 78% of EWA users depend on the service for regular household expenses such as groceries and utilities. Many users also utilize EWA for work-related costs, including transportation for wage earners or fuel expenses for gig workers.

2. Earned Wage Access improves users’ ability to handle emergencies

While the primary use-case for many users is to rely on EWA for daily expenses, it also serves as a resource to meet emergency expenses, with 15% to 39% of users in our studies reporting that they rely on it for urgent financial needs. 64% to 76% of users report an improved capacity to handle emergency expenses, with 17% to 33% experiencing significant improvements. These findings highlight EWA as a valuable part of employees’ financial toolkits.

3. Earned Wage Access enhances financial management, reduces stress, improves quality of life, and has a modest impact on savings

Across the three studies, 48% to 82% of users report improvements in their financial management, with 20% to 36% noting significant gains. Many users mention that the ability to meet expenses in the middle of the pay period helped them stay on top of their bills. Tighter financial management might have modestly helped users increase their savings, with 18% to 52% of users saying their savings have increased, with 4% to 8% noting significant gains.

This improved financial stability may explain why 52% to 85% of users report experiencing reduced financial stress, with 14% to 42% feeling significant relief. Notably, in Vietnam, female users were more likely than male users to report higher stress reduction, possibly due to their primary role in managing household expenses.

Overall, 63% to 83% of users across our studies reported an improved quality of life, with 16% to 32% citing significant improvements. Many users attributed these improvements to reduced stress, better financial management, and greater preparedness for emergencies.

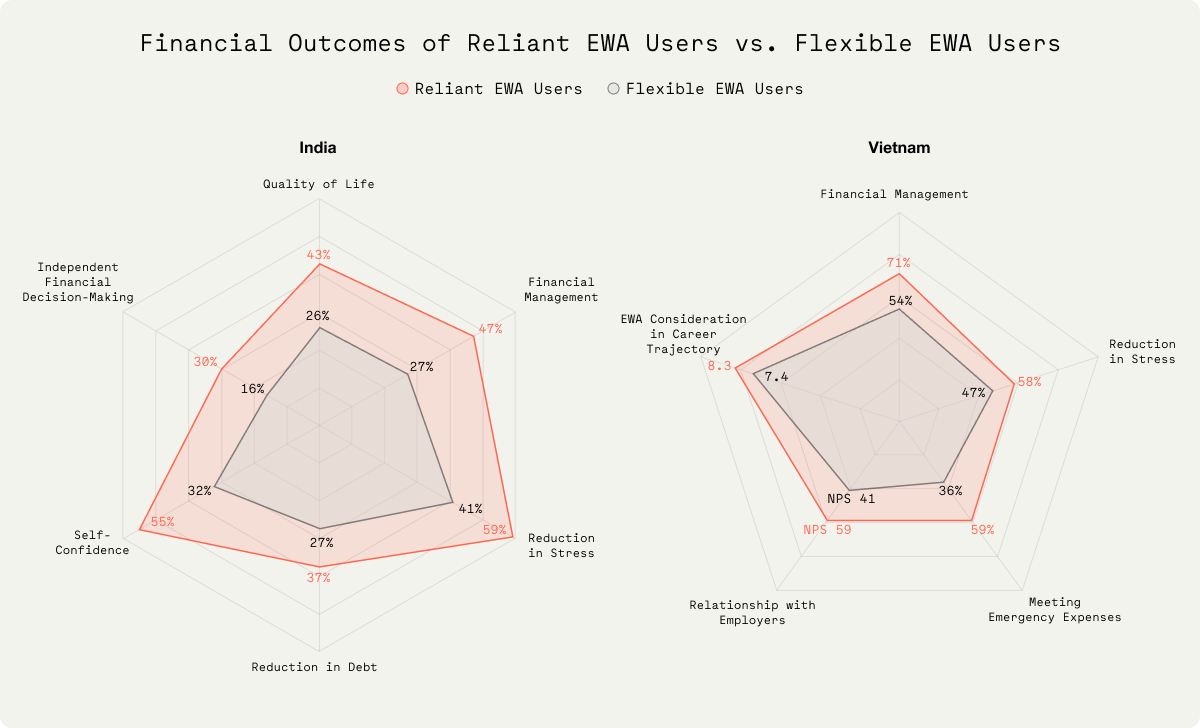

4. Regular EWA users report more substantial financial outcomes but also might be facing higher financial strain in meeting monthly expenses

Users who report that they rely on EWA with each pay period (‘reliant users’) report greater financial stability, lower stress, and improved emergency preparedness compared to users who rely on EWA as needed (‘flexible users’).

Reliant users – EWA users who report that they need to access EWA every pay period/month to meet their regular expenses.

Flexible users – EWA users who report that they do not need to access EWA every pay period/month to meet their regular expenses.

There is additional research needed to help asses EWA’s ability to be a strong financial planning tool in the long run. Data from KarmaLife shows that while reliant users saw a greater reduction in debt compared to their counterparts (37% vs. 27%) and saw improvements in their ability manage their finances (47% vs. 27%), they still found it difficult to cover monthly expenses (29% vs. 18%).

5. EWA is becoming an important factor in job selection

Many users consider EWA a crucial benefit when evaluating new employment opportunities. Employers who proactively offer such financial flexibility therefore might be better positioned to attract and retain top talent.

- In Paywatch, 46% of users rated access to EWA as “extremely important” in job selection, with an average rating of 8.6/10

- In KarmaLife, this sentiment is even stronger, with 70% giving it a 10/10 rating, with an average rating of 9.1/10

- In Ekko, 22% of users rated their need for EWA at the highest level, with an overall average of 7.9/10

6. Users are highly satisfied with EWA and value the timely access to funds

Users from all three countries report high satisfaction with EWA, reflected in Net Promoter Scores (NPS) ranging from 51 to 60. The primary reason for this satisfaction is the timely access to funds.

Future Discussion Questions

Our research highlights several key questions for future studies on the impact of EWA on employees’ lives. In particular, more research is needed to ensure adequate understanding of potential benefits and risks to women workers. In addition, future studies can uncover insights to important questions including:

1. Does reliance on EWA indicate financial precarity or improved financial planning?

> What safeguards can be implemented to prevent over-reliance and ensure fair pricing?

> Does integrating financial capability curriculum with EWA improve financial decision-making and literacy?

> Does access to social protection and other safety nets (insurance, remittances) impact the use patterns of EWA services?

2. Does EWA serve as a gateway to formal financial services?

> How does EWA compare to other credit sources?

> Does it improve financial footprints and encourage greater engagement with formal financial systems?

3. What is the long-term financial impact of EWA?

> Do users transition to greater financial independence, or does reliance persist?

> Could short-term benefits come at the expense of long-term financial stability?

> How does EWA fit into the suite of workplace benefits, such as insurance and pensions? How are wage levels impacted?

Final Thoughts

From Mads Werner, CEO, Ekko:

EWA is just the beginning. While providing early access to wages offers immediate relief, the next step to deeper financial well-being requires deeper solutions—better financial literacy, smarter money management, and systemic change. At Ekko, we believe in a future where every worker has the financial tools they need to thrive, and this report serves as a crucial step in understanding how we get there.

From Badal Malick, CBO and Co-founder, KarmaLife:

We are delighted to partner with ILO and 60 Decibels on this relevant and timely study. Given recent regulatory trends in the digital lending landscape, there is an urgent need for the financial services ecosystem to better understand and distinguish innovative product formats like Earned Wage Access, which cannot only provide a unique, essential and preferred source of capital for India’s blue collar workers, but has demonstrated the ability to positively impact their lives by increasing financial wellbeing, mental health, and self reliance.

From Alex Kim, President, Paywatch:

Paywatch is honored to be part of this global study by 60 Decibels and the International Labour Organization, which highlights the transformative impact of Earned Wage Access on workers’ lives. Paywatch believes that sustainable, fair financial access and financial wellness are fundamental rights. Our mission has thus been to provide the most fairly priced, secure and employee-centric Earned Wage Access (EWA) in Asia.

When done right, EWA can reshape financial habits and become a powerful tool for managing and improving one’s finances. We look forward to seeing more employers adopt EWA globally, recognizing its impact not just on individual financial well-being but also on workforce stability. As more employees gain access to their earned wages when they need them, they can break free from debt cycles, reduce financial stress, and ultimately build a more sustainable future for themselves and their families.

From 60 Decibels:

EWA is transforming how employees access their earnings by providing a flexible, employer-supported alternative to traditional credit. While the benefits and potential of EWA are evident, it is critical to discuss responsible implementation, its impact on long-term financial security, and the role of employers, service providers, and other stakeholders in the ecosystem. The support and coordination mechanisms of global bodies, such as the ILO’s Global Center on Digital Wages for Decent Work, along with research findings from studies on EWA like those conducted by Good Business Lab, will be key to deepening understanding of this space and driving change. As EWA grows, further research will be vital to its development as a sustainable and responsible financial tool.