The 2025 MFI Index

85

39

24,450+

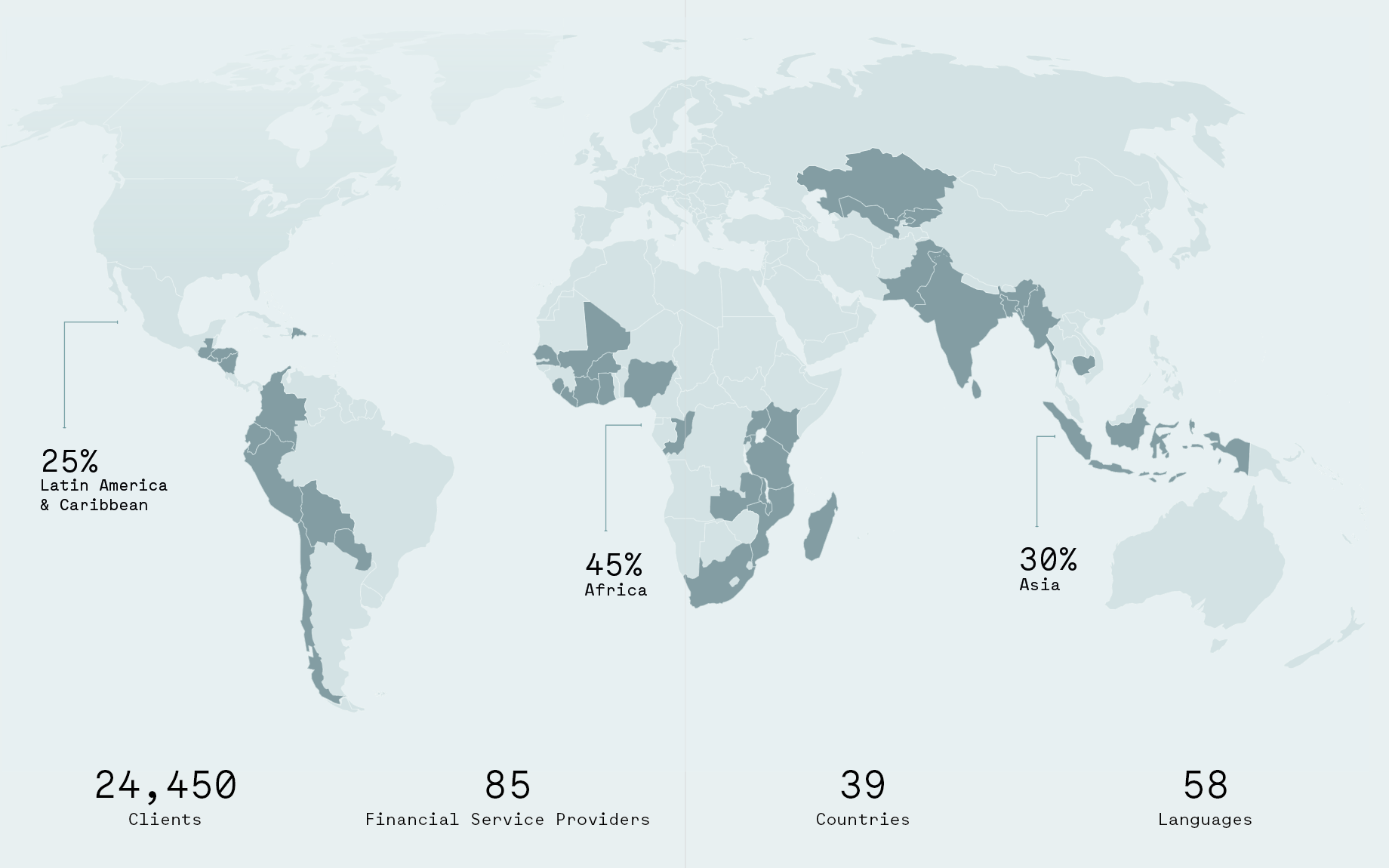

The 2025 MFI Index includes data from more than 85 participating financial service providers (FSPs) and is supported by 21 Partners. Now in its fourth year, the 2025 Microfinance Index has surveyed 24,450+ microfinance clients in 39 countries representing 25 million people globally, with deeper dives into client protection, gender impact, and climate resilience. This year’s survey gathers quantitative and qualitative data along six key dimensions of impact, including Access, Loan Product Impact, Household Impact, Client Protection, Resilience, and Agency.

2025 Headlines

-

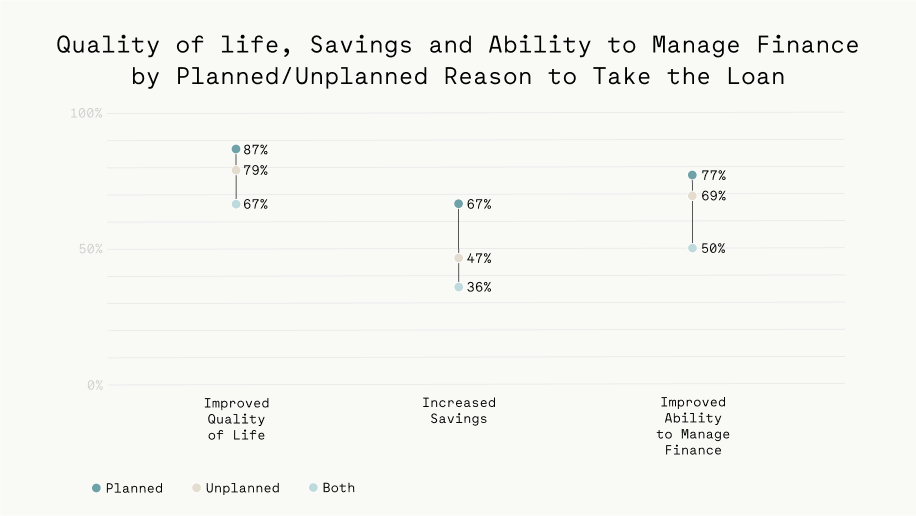

Those who borrow for emergencies risk over-indebtedness.

Clients who plan their borrowing are nearly twice as likely to invest in businesses, and they report significantly stronger outcomes across all measures. These borrowers report better quality of life improvements, improved financial management, and lower repayment burden. In contrast, borrowers taking unplanned loans, often for emergencies, face significantly higher repayment burden and financial stress, reflecting the risks of borrowing during crises without the income-generating foundation needed for sustainable repayment This validates the strong return on investment that intentional use of microfinance loans can have, while also showing the downside risk of emergency-driven borrowing.

![]()

-

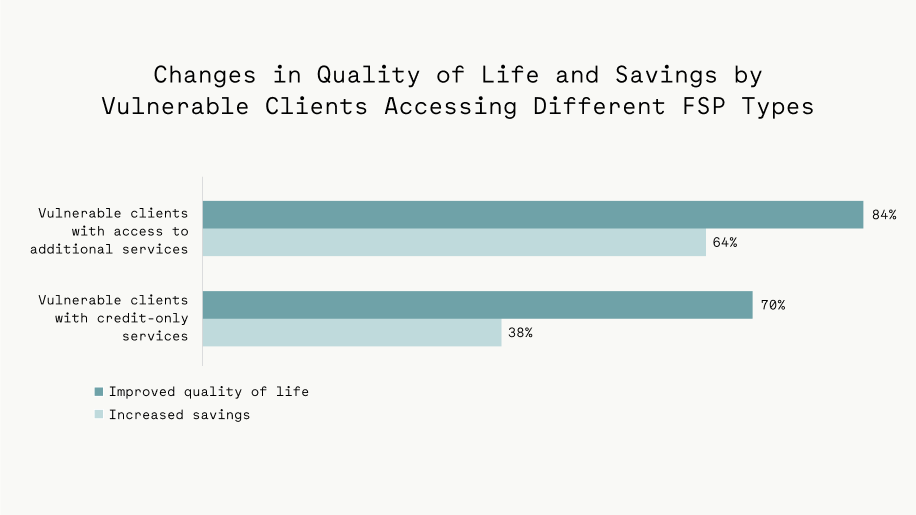

The most vulnerable benefit most when credit is combined with additional services.

The most vulnerable clients—the ones who say they would have the most difficulty coming up with funds to cover emergency expenses, who represent 26% of respondents—report poor outcomes when they only have access to credit. However, when these clients have access to additional services, they report dramatic improvements that are comparable to those of non-vulnerable clients: improvements in quality of life, financial management, and financial resilience. These findings demonstrate that vulnerable clients represent significant impact potential for FSPs, if these FSPs offer comprehensive financial and non-financial services.

![]()

-

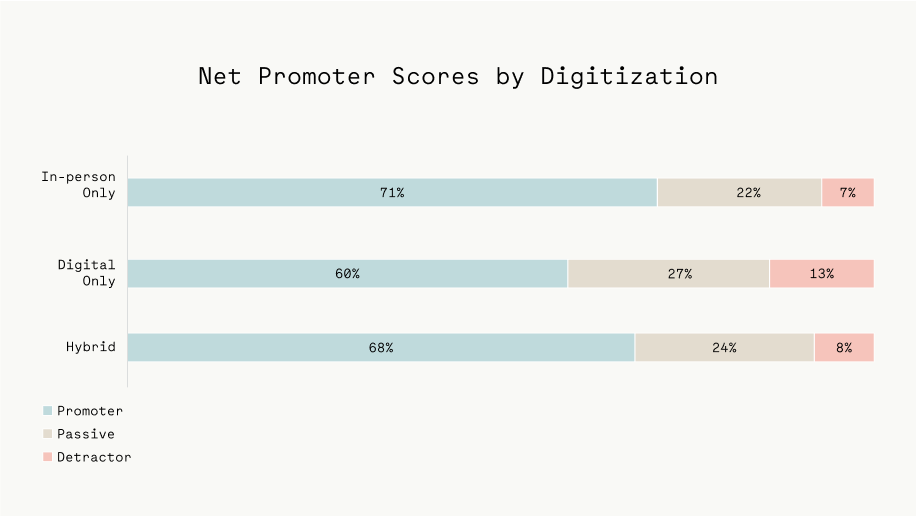

Users of digital-only services are twice as likely to report unexpected fees.

Clients using digital-only services have lower satisfaction and loyalty (NPS) and report weaker impact outcomes. However, hybrid approaches that combine digital efficiency with human interaction achieve satisfaction and impact outcomes approaching those for traditional delivery. This suggests that FSPs can harness the benefits of technology without negatively impacting clients, as long as human interaction remains a part of the client experience.

![]()

-

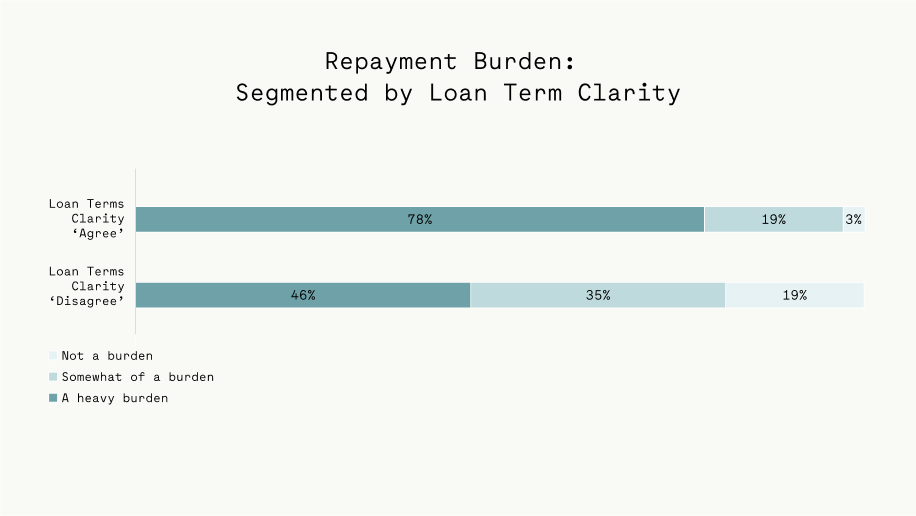

There’s a strong impact dividend to explaining loan terms clearly.

Clients who don’t understand loan terms report much higher repayment burdens, and report lower satisfaction and impact. Our data demonstrate a strong positive correlation between client comprehension of loan terms and client protection outcomes. This correlation holds across lending methodologies, gender, location, and regions, suggesting that FSPs can directly improve client protection for all through better communication and transparency.

![]()

-

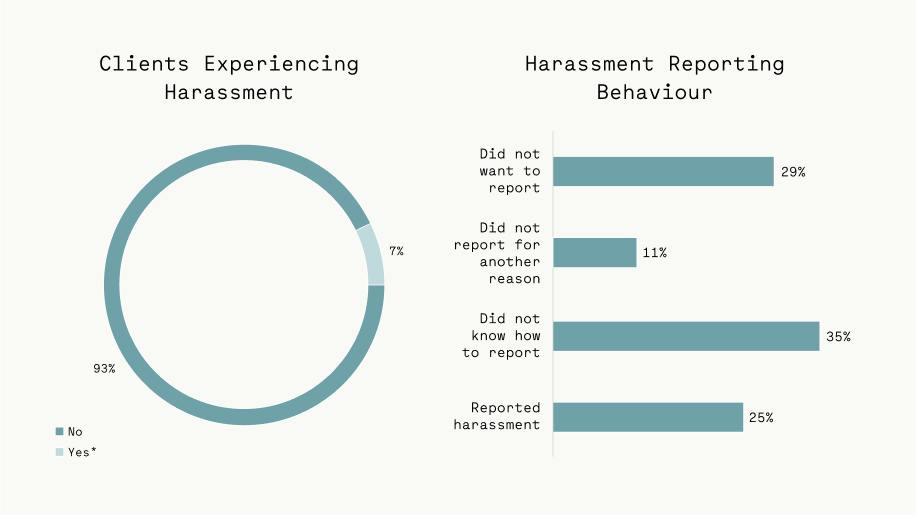

Limited awareness of complaint processes keeps most harassment incidents unreported.

Nearly one in 10 clients experience harassment from FSP representatives, yet only a quarter report these incidents, with a lack of knowledge about complaint processes being a primary barrier. The data also show that clients who understand loan terms are significantly less likely to report experiencing harassment, highlighting how comprehensive client education serves multiple protection functions.

![]()

-

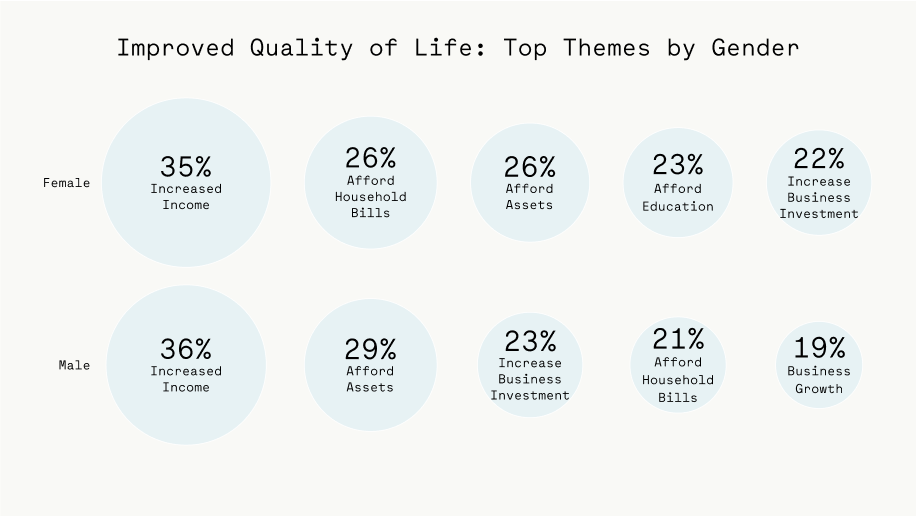

For women, loan success is measured at the household level.

Women represent distinct impact patterns that create opportunities for targeted approaches. Women report dramatically higher satisfaction than men, and, despite higher business loan usage, consistently report measuring success through household welfare improvements, linking quality of life gains to covering household expenses and their ability to access education for their households. These findings suggest FSPs can strengthen outcomes by tailoring services to women’s priorities—their household welfare outcomes.

![]()

-

Non-productive-use loan products create value through different impact pathways.

Non-productive-use loan products (e.g. home improvement loans) operate through different impact pathways than traditional microfinance loans. While clients using these loans report lower financial impacts, they say their quality of life has improved more, and they are more loyal clients. However, these borrowers report elevated repayment burden and increased financial stress. MFIs offering these products must therefore focus on good product design to ensures client protection while still delivering on this distinct value.

![]()

-

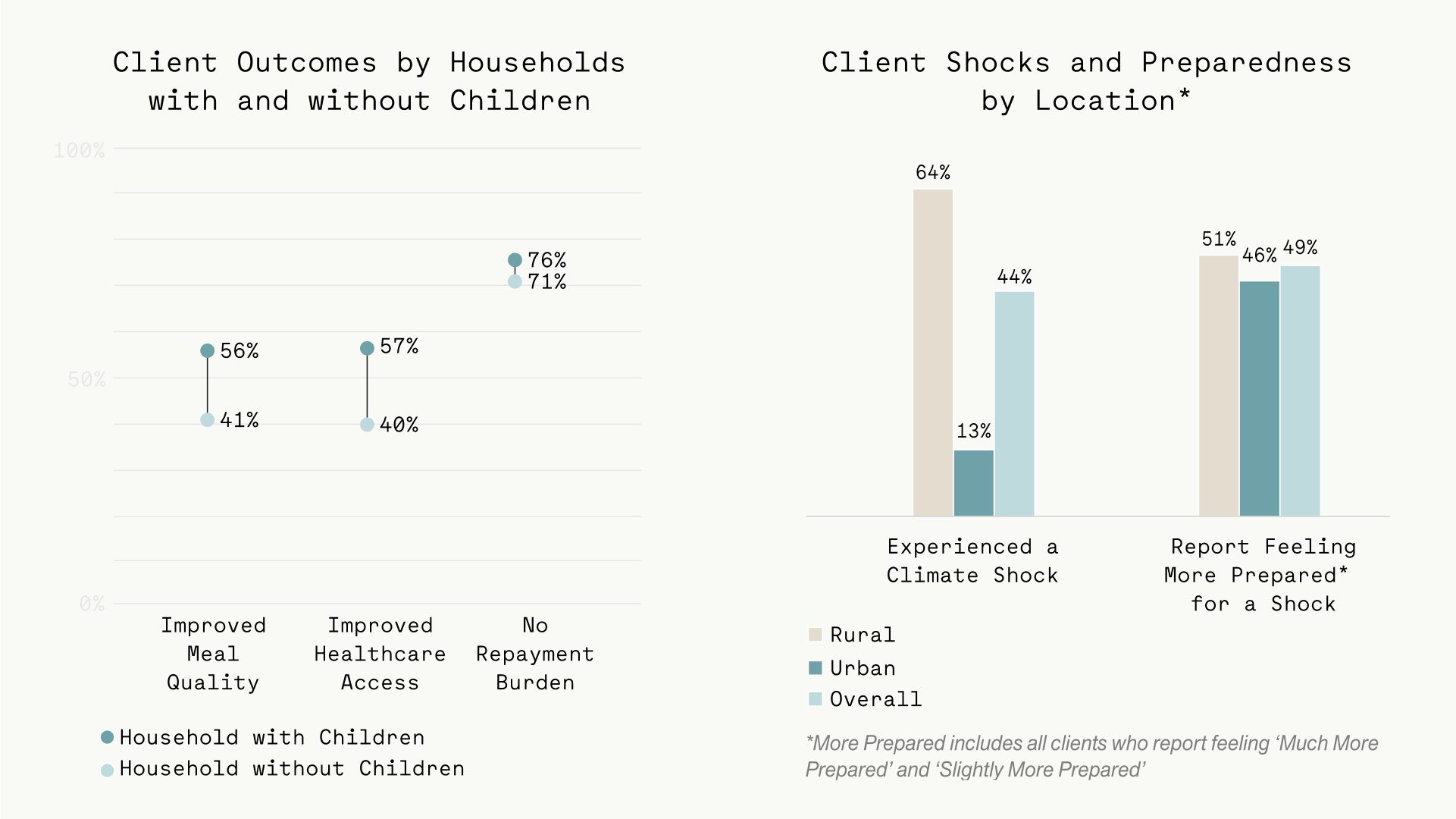

Client household characteristics have significant influence on impact outcomes.

Households with children report improvements in meal quality and healthcare at higher rates than those without children, suggesting that these families direct financial resources toward child-focused expenditures. Rural clients, despite facing disproportionate climate shocks, demonstrate stronger adaptive capacity and preparedness than urban clients. FSPs can maximize impact by recognizing client characteristics as primary determinants of success, be it targeting households with children, or developing location-specific climate products that align with existing adaptation strategies.

![]()

MFI Index Webinars

2025 Microfinance Social Impact Awards

Africa

2. BRAC Liberia Microfinance Company

3. Standard Microfinance Bank

Asia

2. Cashpor Micro Credit

3. Annapurna Finance Pvt.

Latin America

2. Fundación Paraguaya

3. Fundenuse

Why take part in the Microfinance Index?

Synthesized Insights

Discover Top FSPs

Interactive Data