Unpacking Earned Wage Access with Paymenow

Earned Wage Access (EWA), an innovative solution that allows workers to access a portion of their earned income early, is gaining remarkable momentum worldwide. Paymenow, a leading South African fintech company, shows how EWA can empower workers to become financially independent, increasing their quality of life and reducing financial stress. Paymenow deployed an independently verified impact survey via 60 Decibels to understand their strengths (winning a global award in the process) and develop strategies to better serve their customers.

What is Earned Wage Access?

EWA is fast becoming a significant force in modern financial landscapes, addressing cash flow challenges, bolstering financial security, and promoting employee retention.

For a small fee (paid by the employer or worker, depending on the structure), employees can access a percentage of their earned wages ahead of the typical payday. Earned Wage Access as a benefit is growing quickly in the United States: according to a Harvard Business School study, US workers made around 56 million withdrawals amounting to $9.5 billion from earned wage access in 2020, triple what it was in 2017. Many large corporations, like Walmart and Target, offer EWA as a benefit to all employees, with the aim of increasing worker retention. By giving employees access to their earned money before their typical payday, EWA benefits offer a tool to build financial resilience for workers. When faced with an unforeseen financial emergency, workers have the option to access their wages early instead of relying on exploitative alternatives, like predatory loans.

The two different forms of Earned Wage Access

The EWA model usually comes in two forms: Employer-Integrated EWA or Employee-Initiated EWA. In an Employer-Integrated model, EWA companies (like Paymenow) partner with companies’ HR and Payroll departments to offer early wage access as an employee benefit. In this context the EWA company is safely integrated with the payroll platform to allow access to earned wages before payday, and, come payday, any transactions that were advanced during the month is subtracted from the salary before the balance is paid over to the employee. There is no interest or roll-over payments. On the other hand, Employee-Initiated EWA platforms allow workers to independently access their earned wages ahead of the payday. These platforms may be standalone apps or services that employees can opt into. These options are closer to what you’d typically think of a ‘payday loan’.

Global financial markets highlight Earned Wage Access potential

Global trends reveal a growing demand for financial solutions that provide individuals with the flexibility to access their earned wages when needed. A 2022 report by J.P. Morgan interviewed customers around the world and found regional trends that point toward a need for a real-time commerce ecosystem. For populations without access to substantial savings, the timing of payroll and wage access is critical. For example, in Egypt only one in three adults have bank accounts, leaning on cash to pay bills and potentially taking out high-interest loans for regular expenses. In South Africa, nearly 1 in 6 adults – 10 million people – are behind on debt repayments. EWA platforms offer solutions to help smooth workers’ income cycles, giving them the chance to pay for expenses with earned money as opposed to loaned money. Paymenow is paving the way by offering effective EWA programs to South Africans, allowing others to build on their success. Paymenow has also expanded their offering further on the African continent.

Early Wage Access programs in action

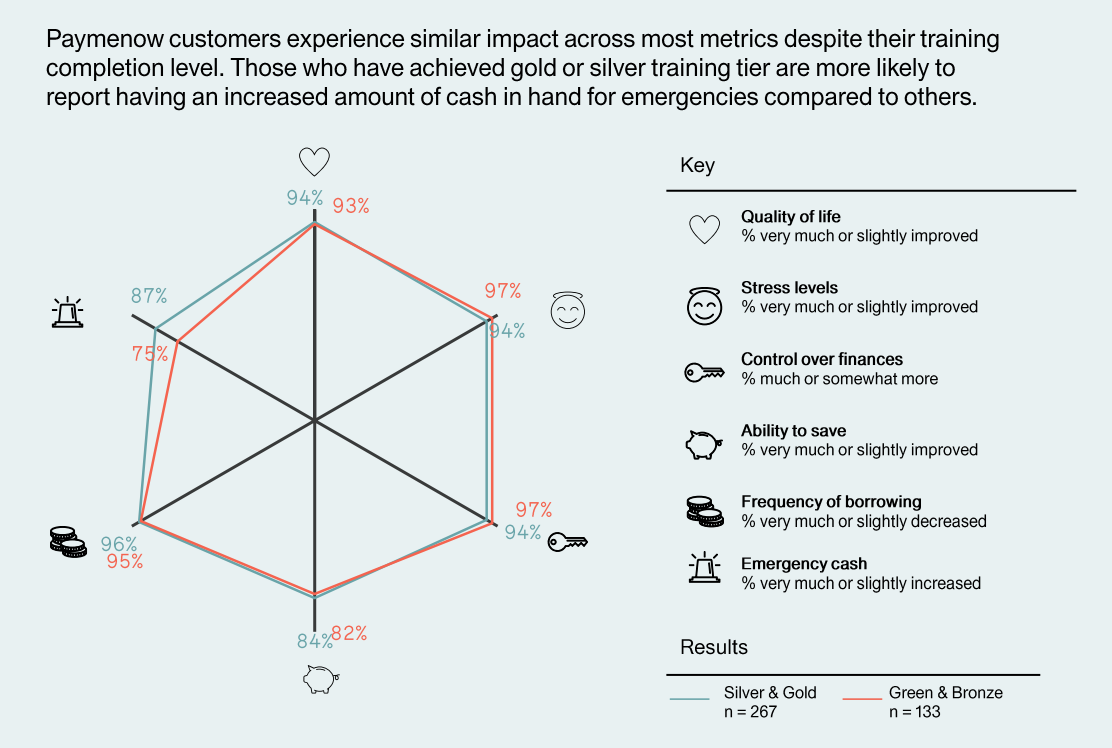

Paymenow grants safe, secure, and responsible access to earned wages to workers whose employers opt-in to their service. Founded on the principles of responsible financial management, Paymenow weaves in a tiered financial education system with the early wages. The fun and informative mini-classes reward users with a gradual increase in access to earned wages as they progress through the tiers, encouraging financial literacy and incentivizing responsible usage with lower fees per tier as well. The platform offers free credit score checks every 45 days, granting users valuable insights into their financial health.

Paymenow’s impact measurement

In the fall of 2022, we worked with Paymenow to understand the impact of their service for their customers via a 60 Decibels Impact Report. The study revealed that a staggering 94% of employees utilizing Paymenow reported an increase in their quality of life, with 95% feeling a reduction in financial stress. Customers are also very happy with the services offered; with an NPS (Net Promoter Score) of 74, and only 8% of clients reporting challenges, Paymenow scores in the top quintile of 60 Decibels’ financial inclusion benchmarks. In plain terms: earned wage access is a program that workers find not only helpful, but necessary.

Celebrating success building new features from 60dB insights

Paymenow’s commitment to financial wellness and inclusion has earned them global acclaim. The platform was recently celebrated at the World Summit Awards Global Congress in Puebla, Mexico. This prestigious event recognized Paymenow’s outstanding contributions to financial inclusion, equality, and innovation. 60dB’s data was a cornerstone in the award application, tangibly proving the impressive impact Paymenow has on its customers. In the spirit of continuously working to improve and innovate, Paymenow introduced a Savings feature where users can deposit as little as $3 USD into an investment fund, a previously inaccessible opportunity for many.

Looking at the feedback from users and how they measured up to the global financial inclusion benchmarks, Paymenow developed new features and programming to better serve their customers. In coordination with a Financial Health Check feature, users can better understand their financial health and access personalized insights to enhance their financial well-being. Recognizing the multifaceted nature of well-being, Paymenow has also introduced a Wellness Support Line. This toll-free, anonymous helpline connects users to qualified counselors who provide financial advice, mental health support, and psycho-social assistance.

Paymenow’s journey from innovative concept to global recognition embodies the transformative power of Earned Wage Access. However, just because a company offers EWA doesn’t mean they’ll have the same impact as Paymenow. Evaluating impact and understanding how an end customer engages with financial products is key to making sure workers feel better off. In order to harness the technological advances of the past decade, today’s financial service providers must be grounded in impact measurement and a clear understanding of their customer’s lived experience. By fostering financial wellness, inclusion, and responsible financial management, EWA companies that follow in Paymenow’s steps stand to not only enhance the lives of its customers but also improve the financial-wellbeing of workers across the world.