Beyond reach: developing a holistic measurement of cash-in cash-out networks

This report, powered by 60dB data, was initially published by the Economist Impact team here.

Financial agents, bank branches, ATMs and mobile apps extend the reach of financial services. For many, they are the first and most important touch points with the financial system. As financial institutions undergo a digital transformation, individuals’ interactions with these physical touch points shape their views on financial services and how they impact their lives. Positive experiences can cultivate users’ trust and help them build the requisite financial capabilities to become savvy, self-directed users. In less optimistic scenarios, negative experiences can replicate unequal power dynamics, disenfranchising users, breeding distrust and contributing to financial disempowerment.

Cash-in Cash-out (CICO) Networks

These touch points make up a network of cash-in cash-out (CICO) providers that help connect an increasingly digital financial system to economies that are heavily dependent on cash transactions. Robust CICO networks facilitate the back-and-forth exchange between physical cash and digital money, playing a significant role in extending the reach of financial services to unbanked and underserved populations.

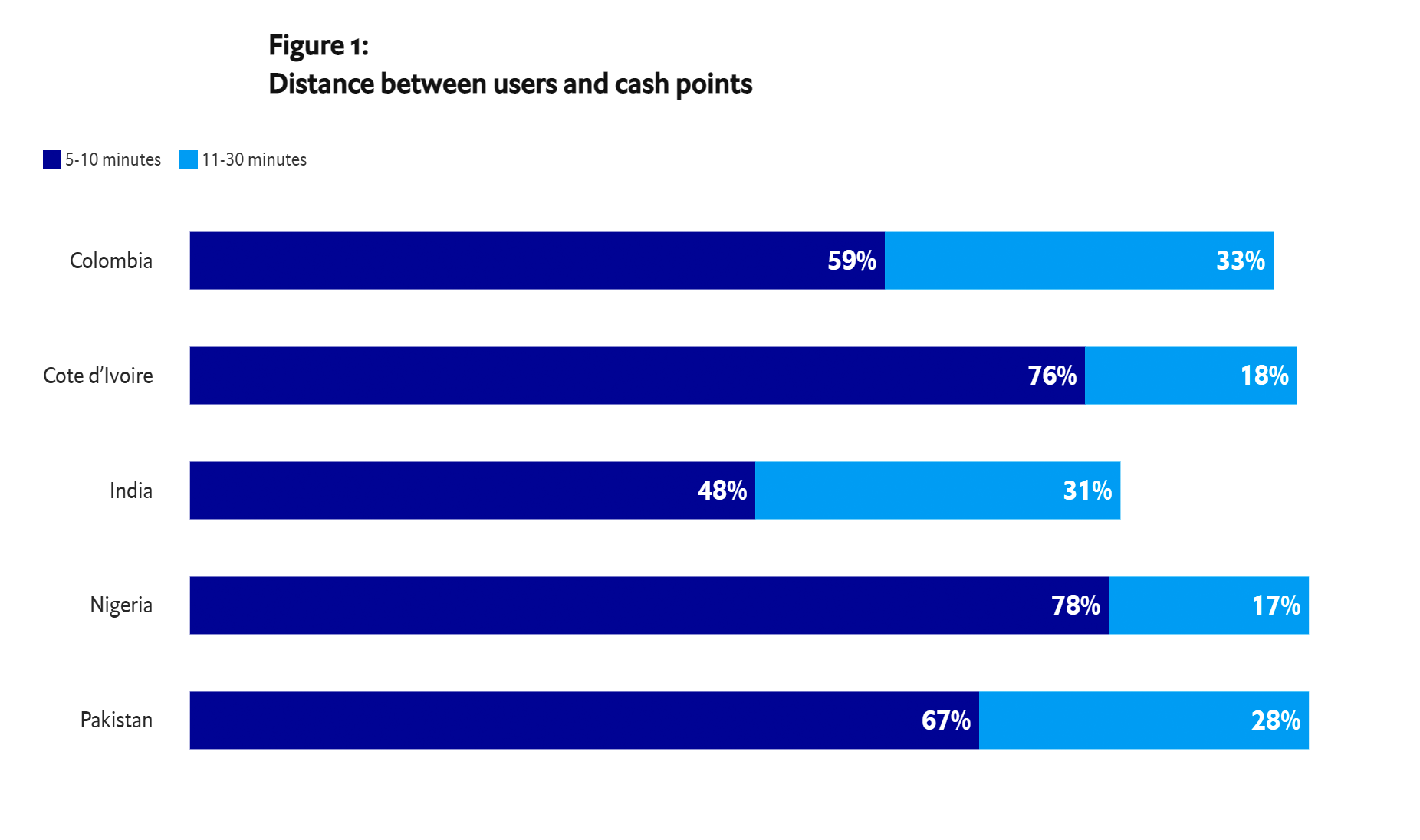

Economist Impact has developed a first-of-its kind Cash Point Diagnostic Tool that provides policymakers, regulators and FSPs with a more complete view of cash points in a specific economy. The tool assesses the services provided by CICO networks and the experiences of their users in three domains: reach, access and quality. During 2022 the Economist Impact team piloted this tool in five key economies: Colombia, Côte d’Ivoire, India, Nigeria and Pakistan.

60dB survey findings uncovered insights about the state of cash point networks, the challenges people face when using them, and opportunities to increase trust and user engagement.

The Economist Impact team highlights six key takeaways

All CICO networks around the world can work to address these six points as we see more and more clients utilizing these networks:

Want to download the full report? Click below. To see the data visualized, check out this page.